The business of a bank is to lend money; which amounts, nowadays, to lending credit-John Buchanan Robinson

Lending is a big business in India, which both, directly and indirectly, touches upon all parts of the economy and people. Apart from the banking sector, several NBFC players contribute to a major percentage of the lending business. With millions of Indians holding loans worth crores of rupees, any technology that can make life easier for the lending sector to improve mitigate the risks of defaults and frauds would be advantageous.

Lending (also known as “financing”) occurs when someone allows another person to borrow something. Money, property, or another asset is given by the lender to the borrower, with the expectation that the borrower will either return the asset or repay the lender. In other words, the lender gives a loan, which creates a debt that the borrower must settle.

Digitalization and the future of lending system

Did you know when was the concept of Lending originated?

1980’s: Online lending is born

The earliest form of informal lending existed between family members and friends and still exists today.

However, the Digital era of the lending system was originated in the 21st century. Banking and Financial services transformed into the digital world which made the pathway to the digital lending system. A lot of financial software is arisen to reduce the manual work and the traditional process involved in the lending system.

The introduction of online banking and mobile banking made the process of lending so easy for the borrower as well as the lender.

In 2010, LendingTree.com survey found that 21% of prospective home loan consumers shopped online. In 2015, BBVA survey states that 45% increase in consumer loans through mobile phones.

Now, with the rise of Fintech made much more changes in the lending system and also gives rise to many peer to peer lending sites. The peer to peer lending sites like Upstart, Lending club, SoFi make the borrower get the loans directly online without any physical appearance. And also sites like Lendbox, Peerform act as a platform for borrower and lender to meet each other online.

Recently, Amazon also enters into the field of lending by providing the loans to the vendors and also providing the educational loan to its prime student customers.

There are much more changes are happening and going to happen in the future. The people are completely moving to the automated world where everything available online inside their smart phones. Since the people are also started using the high price smart phones which may be used as collateral for short-term loans in the future.

Today, online lending is in full swing and only getting bigger. To understand where the world of online loans is headed, we must first understand the basic difference between lending vs borrowing.

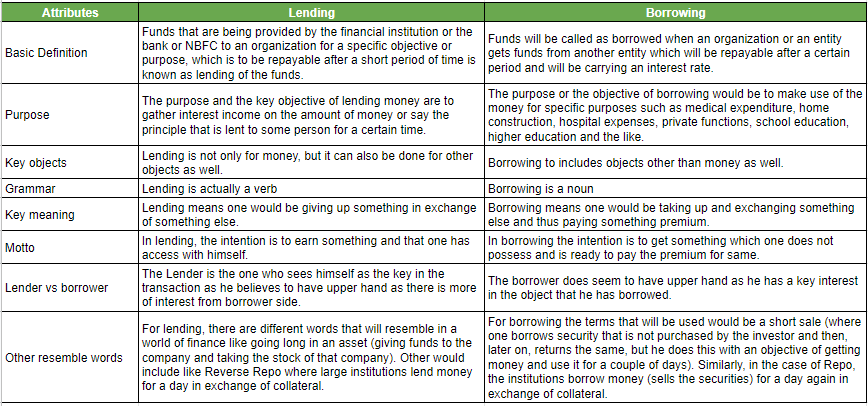

Lending vs Borrowing Comparison

Lending refers to the process when an entity or individual person gives away its recourses to another entity or individual persons as per predefined mutual terms then whereas Borrowing refers to the process of receiving of resources by an entity or individual person from another entity or individual person with predefined mutually agreed upon terms.

Let’s look at the top 8 Comparison between Lending vs Borrowing

Hence Lending is giving money to somebody with the intention of getting it back the original amount which is the principal given and the interest on the principal if it is a commercial loan after a certain time. If a financial institution loans money in the way of the commercial loan then, the financial institution is entitled to charge a certain amount as interest on the principle that it lent.

Borrowing, on another hand, consists of taking money from a financial institution or other people with the intention to return the amount of money which is borrowed after a certain time.

What Is Lending?

Simply put, lending allows someone else to borrow something. In terms of business and finance, lending often occurs in the context of taking out a loan. A lender gives a loan to an entity, which is then expected to repay their debt. Lending can also involve property or another asset, which is eventually returned or paid for in its entirety.

Money Lending Business

Major lending institutions, such as banks, are great for standard loans. However, when it comes to smaller amounts or alternative lending solutions, banks usually cannot accommodate the needs of the prospective borrower like specific a money lending business. This is where having a private lending or hard money lending company shines.

Private Lending vs. Hard Money Lending

If you are interested in starting a money lending business and structuring loans that utilize your own funds as the source of money, then you want to look into opening a private lending company. Not only does this involve a great deal of risk on the part of the business owner, but there also need to be fail safe systems implemented, in order to ensure payments are made on time, and to handle late payments, clients who default on loans, and collections.

Hard money lenders, on the other hand, work with brokers and other sources of money broker businesses in order to structure loans for their clients. This greatly reduces the risk and out-of-pocket spending, plus most of the business will come your way through capital investors, accountants, and even bank referrals for customers who do not quite fit within the structure of a conventional lending institution.

Private money lending also requires the ability to accurately appraise any collateral the client puts up against the loan request. It is prudent to check your appraisals with two or more other sources, just to ensure that the client is putting up assets that are comparable to the amount you are lending.

In addition to all of this, private money lenders also need to keep up with insurance policies. Make sure your clients’ assets are insured against fire, and that they have liability insurance. When structuring a loan, your clients will need to add you to their policy and the insurance company must be informed why you are being added. This way, if something happens to the assets used for collateral, the reimbursement check will be sent to you.

Hard money lenders also have the flexibility to offer short-term or long-term financing. Short-term loans usually have higher fees and interest attached to them, because of the immediate need for working capital, while long-term loans provide a stable profit over the course of years.

In addition to the aforementioned network of investors and brokers, hard money lenders should also work with lawyers familiar with your state’s lending laws, as well as federal regulations for lending. Many lenders also advise working with other hard money lenders to stay familiar with the underwriting process, to ensure that you (as well as the other investors) get paid.

For Both Private and Hard Money Lenders

Both hard money lenders and private lenders alike a money lending business needs to document their loans right down to the smallest details. Even if loans are never finalized, it is a good idea to keep the portfolio on hand in case those clients come back at a future date. When it comes to lending of any sort, there is no such thing as too much information.

There is nothing wrong with increasing your lending radius for you operation. Many lenders make the mistake of keeping a tight geographic radius — often offering loans only within the city where the lender is established. By increasing your reach, you are also making your services available to more potential customers, which means more potential profits for investors, and faster business growth.

Commercial Lending

Commercial financing usually involves someone acting as a liaison between business owners and money lenders in order to reach an agreement. Since more than 60% of all conventional loan applications are rejected by banks, business owners are forced to look at alternative lending methods.

Market Overview:

The Fintech lending industry can be broadly classified under three major segments:-

- SME lending

The lending industry has been witnessing constant developments with technology enabling finance providers to tap into emerging markets, customer data, and lower-cost lending channels. With data analytics and technology-driven approaches, digital lending is offering better products in a faster, more cost-efficient, and engaging way.

According to an ABA survey report, “Digital lending could reach 10% of all individuals and businesses by 2020.” The numbers are likely to be much higher for small and medium enterprises (SMEs) globally.

However, this was not the case with SMEs before. In the past, financial institutions like banks, credit unions, and cooperatives haven’t been able to fund SMEs sufficiently, which consequently confined their growth. A few main challenges were the lack of ease in transactions, high-interest rates, and tedious processes.

That said, SMEs act as a growth engine of economy for developing and developed countries. But, the aforementioned financial challenges have always impacted the SMEs growth, profitability, and financial innovation overall.

How digital lending boosts SMEs growth?

SME loans are now leaning heavily towards digital lending channels. The advent of technology has brought in great scope for easy and convenient loans for underserved part of the market. Here are some ways digital lending is boosting SMEs growth and changing the landscape.

- With the advent of digitalization, the online channels now offer SMEs with a faster loan application process, automated evaluation, and approval.

- Digital lending has made lending processes quick and easy for SMEs significantly cutting down on costs from credit underwriting to operations.

- Digital lending has established unconventional approaches to assess small and medium enterprises by using credit scorecards comprising a host of data from a multitude of sources. It helps to evaluate the creditworthiness of applicants and quickly ensuring risk-free loans.

- With digital lending, risk-profiling can be done quicker and better with the use of both structured and unstructured data.

- Credit decision making has always been slow in case of SMEs; however, with digital lending, applicants now experience seamless decision-making process and faster turnaround time.

- With digital lending, application assessments are quick, accurate, and less expensive. It allows lenders to offer loans at lower interest rates without any guarantor or collateral.

- Digital lending allows SMEs to spend more time in drumming up new opportunities while cutting the overhead cost of generating funds by 30–50%.

Digital lending has significantly closed the gap between lenders and borrowers providing SMEs access to quick and more organized funds. They are now offered with more customized financial and lending solutions to cater to the various needs. The whole market is waking up to marketplace lending (popularly peer to peer lending and crowdfunding) eliminating the need for intermediaries.

Further, digitalization has also allowed banks to leverage technology and automated solutions to gain a competitive edge and speed up the overall lending process. Consequently, enhancing the scope for SMEs for revenue increase and optimization of payments.

2. Consumer Lending (also known as Retail Lending):

Consumer lending function concentrates on providing finance to Individual and household consumers to fulfill their personal, family or household financial needs. Auto loans, Personal loan, credit cards are a few examples of Consumer lending done by financial institutions. Consumer lending, however, does not include debts taken for the purchase of real estate or investments accounts. For example, Mortgages are excluded from consumer lending.

Nowadays, Consumers have numerous options to choose from when it comes to getting consumer loans. It makes it essential for credit unions and financial institutions to differentiate themselves from their competitors. This is done by providing competitive products, world-class services, and a superb digital channel experience & adoption.

3. Online Lending Platforms:

With the continued evolution and expansion of ecommerce and the web, traditional lenders are turning to the Internet for more of the loan origination, underwriting and servicing process. Increasingly, some banks and finance companies are becoming purely online lenders, originating, processing and servicing all of their loans online.

Fully online lenders don’t use the internet just for emails and advertising. They do nearly everything online — to the point that some online lending companies have no “brick and mortar” stores or locations to receive customers.

Growth of online lending:

E-commerce and online lending has become common today, but the web is only about two decades old as we know it. In its early days, financial institutions used the web primarily for advertising and marketing. That is still how many lenders treat the web today, as a way to generate leads and attract prospective borrowers. But as consumers have become more comfortable with the web, especially in making increasingly larger purchase via the internet, more lenders have begun offering potential online borrowers exactly what they want: an online loan.

Though many traditional and institutional lenders still require paper documentation for many loans, digital loans are becoming more acceptable and accepted. Today’s internet allows financing companies, to accept loan applications, approve borrowers, fund loans and even receive loan payments completely through the internet.

Be cautious with instant loans

People should avoid advertisement that are very attractive and promise to process payment quickly with low-interest rates. Advertisement should not be a reason why a person applies for a loan. Before making a decision to deal with one or another company it’s necessary to visit its website and to real all the important information. Carefully read terms and conditions and if possible look for feedbacks about the company in the Internet. It’s important to keep in mind that taking out even a small loan is serious decision and it’s better not to make such decisions on impulse.

The internet has played a key role in facilitating online lending, which is faster and more convenient. Personal Money Service is the best choice if you need online loan. Our company takes care of its consumers and offers clear and easy procedure of taking out a loan so dealing with us is always safe and secured.

Lower-income borrowers benefit:

The growth of online lending could have positive implications for low- and moderate-income (LMI) borrowers, especially as traditional banks enter the arena. Recent research shows that lower income tends to be associated with lower credit scores. As online algorithms develop further, nontraditional criteria can be incorporated to provide a better prediction of a customer’s ability to pay.

Types of Lenders

The most common lenders are banks, credit unions, and other traditional financial institutions. However, there are many other types of lenders, including:

- Peer-to-peer (P2P) lenders

- Crowdfunding contributors

- Family and friends

- Yourself

P2P lenders can operate through online organizations, like LendingClub. These sites connect lenders with borrowers. P2P interest rates may be lower than borrowers would find with a traditional bank, but higher than a lender could receive from a certificate of deposit.

Crowdfunding sites like Kickstarter are similar to P2P lending sites, in that they digitally connect the people who need money with the people who have money. Unlike P2P lending, the people who contribute to crowdfunding efforts may not receive their money back dollar-for-dollar. Instead, they may receive perks from the person or project being funded. For example, someone may donate to a movie project’s Kickstarter, and in return, they’ll receive a copy of the movie once it’s completed.

Family and friends can become lenders, and these transactions are sometimes called “private party loans.” It’s important to consider the impact a loan might have on your personal relationship with these people. A loan agreement may help ensure everyone is on the same page.

If you have the means, you can loan your own money to your business, as an alternative to investing in it. If you choose to loan yourself money, write a contract that specifically spells out your role as a lender, the payment schedule, and the consequences for defaulting on payments.

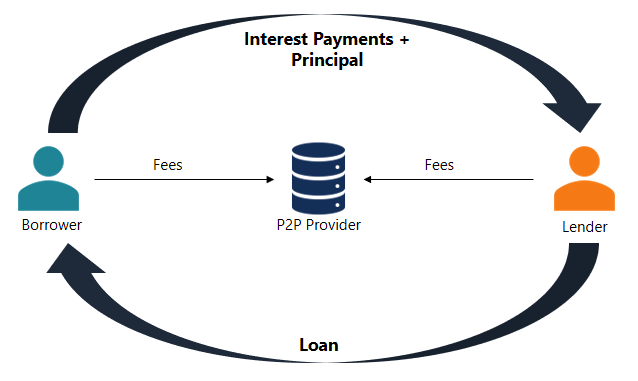

What Is Peer-to-Peer Lending?

Peer-to-peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary(It acts as a middleman between two parties in order to facilitate a financial transaction.)in the deal. P2P lending is generally done through online platforms that match lenders with the potential borrowers.

P2P lending offers both secured and unsecured loans. However, most of the loans in P2P lending are unsecured personal loans. Secured loans are rare for the industry and are usually backed by luxury goods. Due to some unique characteristics, peer-to-peer lending is considered as an alternative source of financing.

Peer-to-peer (P2P) lending, sometimes called “social” or “crowd” lending, is a type of financing that connects people or entities willing to loan money with people or businesses that want to borrow money. As an alternative to traditional financing, a financial tech company (aka fintech) creates an online platform that matches loan applicants directly with investors.

Your rate and terms (and whether you qualify in the first place) are still based on common factors that other lenders consider. For example, your credit score, credit history, and income will each play a big role in your ability to qualify for a P2P loan and the price you pay for financing if you do.

If you have excellent credit, sufficient income, and a low DTI ratio, you might find a good deal on a P2P loan. However, if you have credit problems or other borrowing challenges, finding a competitive loan offer (or even qualifying at all) may be a challenge.

Therefore a bank offers P2P lending by allocating capital from the lending party to the borrowing party while acting as the broker, as well as the risk mitigator. The higher the risk, the higher is the imposed interest rate. Fintech organizations have made this simpler and more effective.

Several Fintech P2P lending firms like LendingClub and Prosper offer a platform where individuals gain interest by lending money to the ones who require it. These firms make money by taking a small fee for making the connection among the two parties possible.

How Does Peer-to-Peer Lending Work?

When you apply for a P2P loan, the process typically involves the following steps.

- You complete and submit an online application. This step will usually include a credit inquiry — either soft or hard.

- The lending platform may assign you a risk category or grade. Your rating will impact the interest rate and terms you’re offered. If you’re satisfied with an offer, you can opt to move forward.

- Investors review your loan request. You can include details such as how you plan to spend the money or why loaning money to you is a good risk. Your story may improve your odds of receiving funding. Depending on how the P2P platform is structured, lenders may make bids to try to win your business. However, your loan request might also be passed over.

- You accept the loan. If an investor makes a bid that you’re happy with, you can review the terms and accept the loan. Depending on the platform, the funds could be deposited into your bank account as soon as the same day or within a week.

- You make monthly payments. In general, P2P lenders report accounts to the credit bureaus like traditional lenders, so late payments could hurt your credit score. Late payments may also come with late fees that increase your overall cost of borrowing.

Advantages and disadvantages of peer-to-peer lending

Peer-to-peer lending provides some significant advantages to both borrowers and lenders:

- Higher returns to the investors: P2P lending generally provides higher returns to the investors relative to other types of investments.

- More accessible source of funding: For some borrowers, peer-to-peer lending is a more accessible source of funding than conventional loans from financial institutions. This may be caused by the low credit rating of the borrower or atypical purpose of the loan.

- Lower interest rates: P2P loans usually come with lower interest rates because of the greater competition between lenders and lower origination fees.

Nevertheless, peer-to-peer lending comes with a few disadvantages:

- Credit risk: Peer-to-peer loans are exposed to high credit risks. Many borrowers who apply for P2P loans possess low credit ratings that do not allow them to obtain a conventional loan from a bank. Therefore, a lender should be aware of the default probability of his/her counterparty.

- No insurance/government protection: The government does not provide insurance or any form of protection to the lenders in case of the borrower’s default.

- Legislation: Some jurisdictions do not allow peer-to-peer lending or require the companies that provide such services to comply with investment regulations. Therefore, peer-to-peer lending may not be available to some borrowers or lenders.

Types of Loans Available Through Peer-to-Peer Lending

P2P loans can be used for many of the same purposes as personal loans. Here are a few of the loan types you may find on popular P2P websites.

- Personal Loans

- Home Improvement Loans

- Auto Loans

- Student Loans

- Medical Loans

- Business Loans

Key Findings Business Opportunities

The major business opportunities prevailing in the Fintech lending industry are-

- Point-of-sale (POS) based lending which provides easy access to merchant related data which allows easy credit check.

- Peer-to-peer (P2P) based lending allows individuals to lend to another individual.

- Invoice based lending aims at financing merchants against the amount due from customer i.e. account receivables

- Short term lending gives users credit in customized manner, which allows them to make instant purchases. The ‘buy now, pay later’ model based on a similar concept is being adopted by companies to target a new set of customers. Even as new business models are being used to penetrate the market, increasing credit demand from consumers and MSME offers an addressable opportunity in the coming years.

Key Risks and Challenges

The following risks/ challenges with Fintech lending have been identified-

- Liquidity squeeze can cause interest rates to rise directly impacting end customers.

- Business viability is questionable as default rate increases

- There are no clear guidelines for first loan default guarantee, which can provide safety to lenders.

- Bad loan ratio of NBFCs have almost doubled in last 5 years.

- Borrowed money from NBFCs and banks for lending comes with a high interest rate.

- RBI lending regulations such as P2P lending law which caps maximum lending or borrowing by a single vendor to USD 0.014 mn (INR 10 lakhs)

- Talent is a challenge for Fintech lending companies

Benefits for borrowers

Benefits enjoyed by borrowers revolve around the interest rates, speed of the funding, higher funding rates, and the ease of application process.

- Ease of applying: Getting approved is as easy as putting in a few lines of personal information in an online form. This can be done from anywhere with access to the internet and a computer. Once applied, and approved, you need to wait for your loan to be funded.

- Reduced interest: Another benefit of P2P lending for borrowers is the bank-like interest rates. Even the largest P2P lenders quote rates of approximately 7% APR. Once approved, the borrowers will also be offered several payback timelines that range from one, three, or five years. The interest rate is adjusted according to the term selected.

- Higher funding rates: The funding amounts in the p2p model have increased over time. As of today, the amounts are quite substantial and range from $1,000 to $35,000. Goes without saying, the higher you go up the spectrum, the more meaningful project or purchase you’ll be funding.

- Speed of funding: Funding typically takes one week to three weeks, and it depends on the size of the loan required. Small loans under $2,000 are even filled in just a few days and funded in less than a week. This speed is extremely convenient for the borrowers as they have to wait less!

Benefits for lenders

Lenders win by spreading their risk through a variety of transactions and getting returns above market rates.

- Reduced risk: In case of P2P lending, the lenders are not generally big institutions. The majority of loans are filled in smaller increments by normal individuals. Lenders are obviously attracted to an alternative to the otherwise high risk and low rates provided through a traditional financial institution.

- Lenders choose: P2P lenders get the option of categorizing the borrowers and ensure that they pass identity verifications. Borrowers are given terms and rates associated with their credit score and other related factors in the algorithm. Lenders can choose to invest in loans that invest them. If they don’t like someone that is consolidating credit card debt, they can choose to not invest.

- High returns: The returns average near 10% depending on the types of loans you choose and the term you opt for. In today’s market, a 10% return is definitely quite attractive. This is especially because it is diversified into large pools of pre-qualified and FICO verified borrowers.

Never a Lender or Borrower Be?

Peer-to-peer lenders are a relatively new phenomenon. Should you use one on either side of the equation?

Pros for Borrowers

- For those with imperfect credit, p2p lenders are often more willing to loan money than banks.

- Depending on your credit score, you may get a better interest rate with a p2p lender than a bank.

- The process is fast and can be done entirely online.

- You can window shop for the best rates with no impact to your credit score.

- Many p2p lenders charge fewer fees than banks.

- Borrowers don’t need collateral.

Cons for Borrowers

- You can’t borrow your way out of debt. If you get a p2p loan for debt consolidation but don’t curb irresponsible spending, you’ll only compound the problem.

- For those with bad credit, the interest rates are high.

Pros for Lenders

- Some platforms have very small minimums.

- Thousands of loans to choose from.

- A great way to diversify investments.

- Provides passive income in the form of the monthly payments investors receive.

Cons for Lenders

- Some platforms require investors to be accredited, putting them out of reach for many.

- Borrowers may default making p2p investing something of a high-risk investment.

- In order to be considered diversified within p2p investing, some experts suggest investing in as many as 175 loans. This is a lot to keep track of.

- Your money is locked up for the term of the loan which can be up to five years. Once you make the investment, you can’t sell it.

In our estimation, there are more cons for potential investors than borrowers. As long as you’re borrowing for the right reason (to consolidate debt not to go on a blow-out vacation, for example), a p2p loan can be a great tool.

That’s not to say p2p can’t be an excellent tool for investors too, but it does come with some risk. Of course, all investments do, but if you buy stock in Apple, it’s pretty unlikely that the company will go under and you’ll lose all of your investment. Whereas if a borrower defaults on a loan, something that does happen, you’ve invested it, you do indeed lose all of your investment.

Take the risk or lose the chance.

If you’re going to invest this way, make sure it’s with money you can afford to lose, you carefully research each borrower before funding their loan, and you diversify by investing relatively small amounts across several loans.

Because sometimes it does pay to borrow and lend.

Lending terms

Lending terms vary considerably, depending on your credit score, income, type and amount of loan and other considerations. Typically, loans have a length of three years or longer.

We saw advertised 5/1 adjustable rate mortgages starting at 2.97 percent APRs, but your APR could go as high as 29.9 percent.

LendingTree’s website points out that you can search for loans without first giving information (through its Loan Explorer), that there are no commitments and that the quotes are personalized.

How to Create a Lending Business

Money lending is a lucrative business with an almost unlimited supply of customers. Consumers buy cars, homes, electronics and educations through financing. Someone has to lend that money to creditworthy individuals. You can form a lending business and get your piece of the lending pie. A background in accounting or banking is advisable but not necessary. You can hire professionals to manage the parts of the business you do not understand. An eye for detail and a willingness to lend out your own money will get you on the path to lending profits.

- Gather together a group of like-minded investors. Meet with each potential partner individually to assess his goals. Meet with the entire group as a whole to outline the goals of your company.

- Take your outline and write a detailed business plan. Visit with your attorney and pay him to assist you in the formation of a corporation placing each investor on the board with you as the CEO.

- Register your corporation with the Securities and Exchange Commission and the IRS. Purchase a business license from the county clerk in the area where you want to open your first store front.

- Meet with your investors and your attorney. Have your attorney describe your articles of incorporation to all of the members. Sign the documentation provided by your attorney and have your partners sign as well.

- Start your lending company at a single location. Meet the local lending needs in that area. Build a reputation as a company that offers fair rates as well as one that will pursue any unpaid debt.

- Expand slowly into the surrounding areas. Keep your new lending locations close enough to the first one to take advantage of its reputation but far enough away so that there is no self competition.

- Move into online lending. Hire professional website designers capable of protecting your money and your clients’ private information. Monitor your website daily for your own protection.

Warnings: Always protect your records. As a lender, you will be entrusted with each borrower’s private information. Leaking these records either accidentally or on purpose will expose your corporation to civil litigation and possible criminal charges.

6 Tips for a Successful Private Lending Practice:

Following disciplines helped tremendously in growing a thriving private lending brokerage.

- Stay local. The private lending business model is most successful when you focus locally. Most of your loans should be within 100 miles of your office. Most of your private lenders will be local to your community. You will succeed in funding loans because you are a local expert and you understand your local marketplace. Remember that a reputable private lender is really in the investment business first, and the lending business second. Invest in what you know and where you know.

- Find your sweet spot. If the funding capacity of the majority your investors ranges from, say, $50,000 to $250,000, then market this range as your niche. Be honest with your referral network as to your sweet spot. Besides, a guy that needs a $50K loan will not be well served by a broker who regularly funds million dollar loans. Build your book of business by starting out small, creating volume, then working your way up to larger loans. You can earn more in fees by doing 5 — $50,000 loans than 1 — $500,000 loan or even 1 — $1 million loan! You can charge more points on smaller loans, plus the fees. They close quicker and easier. Larger loans fail to close at a much higher rate than smaller loans.

- Focus: Be specific in your advertising and marketing. Don’t say that you are “nationwide” and you fund “all loan types” and loan amounts. I guarantee you that brokers who market themselves as such do not have a thriving business.

- Strive for total transparency: If you check out our website you will notice that we don’t have pictures of skyscrapers or smiling people in suits shaking hands. We have pictures of actual deals we have funded. We have our names, addresses, pictures and email addresses for all the world to see. We use our direct phone number with area code so people know our business is located in the San Francisco Bay Area. Google us and you will find our detailed LinkedIn profiles. We’ve never pretended to be something we weren’t. Your authenticity and transparency will attract customers to you in a big way.

- Refer, don’t broker. We originate loans. We rarely broker loans to other brokers. But we refer deals almost every day. When a call comes in for a loan that’s outside of our area, expertise or capacity, we will refer that caller to one or more brokers from our database of reputable private loan originators. Brokering, in most cases, is a waste of your focus and time. Especially if the lead is coming from another broker. You do not want to be in the middle of a daisy chain. Daisy chain deals mostly fail because the borrower does not get well served. The reason they fail is that there is no way for every agent to get paid without over-charging the borrower. The universe will reward you if you selflessly refer to other brokers those leads which don’t fit your niche. Because of the literally hundreds of leads we have referred to other lenders over the past several years, the goodwill it created has resulted in referrals coming back to us daily from people to whom we selflessly referred business months or even years ago.

- Coaching, Mentoring & Consulting. The best investments you can make are in yourself and your business. Success and leadership coaching are an important part of my life. The books you read, the seminars you attend and the videos you watch will help you to master the disciplines you need in order to succeed in a world full of distractions and naysayers. Attend industry conferences and seek out those who have achieved success in this business and follow their advice. Hire an industry professional to review your practices and help you achieve compliance with state and federal regulations. Conduct this business properly, and soon you will have a steady stream of new leads as you grow your local reputation for performance and thoroughness.

How Do Lenders Make Money?

Banks and other lenders are in business to make money. Financial institutions pay a low interest rate on depositor accounts such as savings and money market accounts, then use that money to lend money to borrowers at a higher interest rate in the form of loans and credit cards.

It may sound like lenders are the bad guy, but they actually serve a purpose in the economy. However, because lenders have an interest in maximizing their profits, lending also comes with costs and cautions.

Why Consider Safe, Online Business Lending?

Legitimate online lenders know that their business success hinges upon their own reputation for keeping their customer’s information secure and private. These companies take steps to protect their own business and that of their customers and applicants. Obviously, this is the type of finance company that you would want to do business with either online or offline. Online lenders may provide the right solution for your business. Some benefits could include fast or even instant online decisions and very quick funding. For many business owners, an internet lending platform can be a much quicker and more accessible solution than traditional banks, small business credit cards and other funding sources. If you do your own due diligence and choose a secure lending platform, you’re likely to be satisfied with your decision to borrow from an internet lender.

Why lending tree? Is it Legit? Are They Worth It?

Lending Tree is one of the first and largest peer-to-peer online lending exchanges, was founded in 1996 and is currently America’s leading online lending marketplace. Its headquarters are in Charlotte, North Carolina, with offices in San Francisco, NYC, Chicago, and Seattle.

LendingTree helps borrowers find many different types of loans (such as personal loans and mortgages) through a lending marketplace.

With LendingTree, you can borrow for things like…

…home loans, auto loans, small business loans, personal loans, credit cards, and much more!

Multiple lenders compete for your business on the LendingTree platform, but keep in mind that LendingTree is not a lender itself.

With an overall rating of Excellent (81%) from 7,462 reviews on Trustpilot and a B rating from the Better Business Bureau, you can rest assured Lending Tree is a legit way to efficiently compare multiple lending offers by filling in one simple form.

Okay, here is the question you have all been waiting for.

Is LendingTree legit?

The verdict is in, and…

…LendingTree is 100%, certified legit.

LendingTree will connect you with lenders, and the service is completely free.

One of the main criticisms of LendingTree is the potential for “hard pulls” on your credit by lenders.

This should not be occurring, and it did not happen in my experience with the Company.

However, there are a couple points to keep in mind to protect your credit:

- Monitor your credit score (whether via LendingTree or another free service)

- Multiple “hard pulls” in a 45-day period count the same as a single hard pull

Hard pulls by lenders is out of LendingTree’s hands, but again, it should not happen.

Additionally, it is not a huge deal (but is certainly obnoxious) for your overall credit score.

Again, this did not occur in my experience, but it is worth noting here.

In summary, LendingTree delivers on what they promise.

The Company will connect you with lenders and find you the loan you need.

Lending Policy of Banks

The major business of banking company is to grant loans and advances to traders as well as commercial and industrial institutes. The most important use of banks money is lending. Yet, there are risks in lending. While lending loans or advances the banks usually keep such securities and assets as a supports so that lending may be safe and secured. Suppose, any particular state is hit by disasters but the bank shall get advantages from the lending to another states units. Thus, the effect on the entire business of banking is reduced. So the banks follow certain principles to minimize the risk.

5 Important Principles Followed by the Banks for Lending Money

Following are the important areas to be taken care while lending:

- Safety: Normally the bank uses the money of depositors in granting loans and advances. Because of that while granting loans the banker should think about the safety of depositor’s money. The purpose behind the safety is to see the financial position of the borrower, whether he can pay the debt as well as interest easily.

- Liquidity: It is a legal duty of a banker to pay the total deposited money to the depositor on demand. So the banker has to keep certain percent cash of the total deposits in hand. Moreover the bank grants loan. It is also for the addition of short term or productive capital. Such type of lending is recovered on demand.

- Profitability: Commercial banks are profit earning institutes; nationalized banks are also not an exception. They should have planning of deposits in a profitability way to pay more interest to the depositors and more salary to the employees. Before taking any decision the banker should make sure that it is profitable.

- Purpose of loan: Banks never lend or advance for any type of purpose that will lead to loose of money. The banks grant loans and advances for the safety of its wealth, and assurance of recovery of loan and the bank lends only for productive purposes. Before giving a loan the bank has to make sure that whether the purpose for which the loan has given is productive or not.

- Principle of diversification of risks: A bank should be very careful while lending loans because if the bank lends to a non credit worthy customer, it will affect the survival of the bank. To diversify the lending risk they should lend loans to customers from different sectors such as agriculture, housing, educational, etc. Concentrating on a particular set of customers will adversely affect the bank. Diversification aims at minimizing risk of the investment portfolio of a bank.

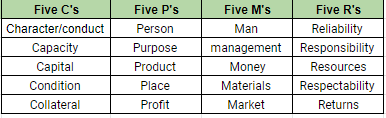

The Six Basic C’s of Lending

Credit analysis by a lender is used to determine the risk associated with making a loan. Regardless of the type of financing needed, a bank or lending institution will be interested in both your business and personal financials. Credit analysis is governed by below listed parameters:-

- Character — Specific Purpose For Loan and Serious Intent to Repay Loan: Lenders need to know the borrower and guarantors are honest and have integrity. Additionally, the lender needs to be confident the applicant has the background, education, industry knowledge and experience required to successfully operate the business. Lending institutions may require a certain amount of management and/or ownership experience. They will also ask about your licensing and whether or not you have a criminal record.

As history is the best predictor of the future, a lender will examine the personal credit of all borrowers and guarantors involved in the loan. Sound business and personal credits are a must. Check both reports before calling your lender; if there are any delinquencies, be prepared to explain. The lender may be able to make exceptions for low credit scores.

- Capacity — Customer Has Legal Authority to Sign Binding Contract: Perhaps the most important factor lenders consider when deciding to approve a loan is the company’s capacity to repay it. By comparing your past history of debt repayments as well as the current debt you might be carrying, lenders will determine your propensity to make payments on a regular basis. If the business you’re starting is still in the idea phase and not currently producing revenue, your chances of obtaining a loan may be diminished since you can’t show how you’ll repay it.

- Cash — Does the Borrower Have the Ability to Generate Enough Cash to Repay the Loan: The business should have sufficient cash flow to support its business expenses and debts comfortably while also providing principals’ salaries sufficient to support personal expenses and debts. Examining the payment history of current loans and expenses is an indicator of the borrower’s reliability to make loan payments.

- Collateral — Does the Borrower Have Adequate Assets to Support the Loan: A lender will consider the value of the business’ assets and the personal assets of the guarantors as a secondary source of repayment. Collateral is an important consideration, but its significance varies depending on the type of loan. A lender will be able to explain the types of collateral needed for your loan.

The amount of collateral that is taken must reflect that element of doubt.

“Many customers believe that the primary requirement for obtaining a loan from a bank is the availability of satisfactory security, but this is a misconception. No doubt banks are concerned with the security that a customer can offer for a loan but this ought not to be the first or only consideration”.- Weerasooria

- Conditions — Must Look At the Industry and Changing Economic Conditions to Assess Ability to Repay: The lender will need to understand the condition of the business, the industry, and the economy, which is why it is important to work with a lender who understands the WCB industry. The lender will want to know if the current conditions of the business will continue, improve or deteriorate. Furthermore, the lender will want to know how the loan proceeds will be used- working capital, renovations, additional equipment, etc.

- Control — Does Loan Meet Written Loan Policy and How Would Changing Laws and Regulations Affect Loan: Your lender will ask what personal investment you plan to make in the business. Not only does injecting capital decrease the chance of default, but contributing personal assets also indicates that you are willing to take a personal risk for the sake of your business; it shows that you have ‘skin in the game.’

Lenders all have different thresholds for what constitutes an appropriate credit score. Some want borrowers to have exemplary scores, while others are much more flexible in this aspect. In fact, many alternative lenders will approve a small-business loan even if the borrower has bad or no credit at all.

These components that make up a credit analysis help the lender understand the owner and the business and determine credit worthiness. By knowing each of the “6 Cs,” you will have a better understanding of what is needed and how to prepare for the loan application process.

Top 10 Fintech Companies in the Indian Lending Space

1. MoneyTap: MoneyTap is a Bengaluru-based fintech company. It disrupted the digital lending business by offering lines of credit in the form of personal loans for consumers, in partnership with RBL Bank. It recently received an NBFC license, which they intend to use to enter into co-lending space with their lending partners. This allows them to offer better interest rates to customers.

MoneyTap has been offering quick collateral-free personal loans to borrowers since 2016. One of its notable features is that it has a very simple documentation process for getting a personal loan. The mobile app also allows you to keep track of all the borrowings.

2. Capital Float: Capital Float is owned by CapFloat Financial Services and it offers specialized financial loans and credit to businesses. This fintech company uses its own proprietary loan underwriting systems to lend to potential borrowers.

It has partnerships with clients like Uber, PayTM and Shopclues. It is now aiming to reach out to kirana store owners and small-time merchants.

3. MobiKwik: MobiKwik was founded in 2009 and it started as a digital payments company, where it provided a phone-based payment system. MobiKwik is an issuer-independent digital financial services platform, the company has forayed into various segments of the fintech ecosystem including digital wallets, wealth management, insurance and more.

Low customer acquisition cost, inbuilt scoring model, and quick disbursal of loans have been the key differentiators for MobiKwik. MobiKwik was one of the first to disburse a loan amount in a matter of 90 seconds.

The company eventually grew into a digital financial services platform and boasts of a customer base of 100 million.

4. Shubh Loans: This Bengaluru-based fintech startup allows borrowers to avail a loan within the range of Rs.75,000 to Rs.5 lakh. They aim to provide loans to the underserved segment in India.

They offer an easy documentation process, where an agent will pick up the documents at a pre-scheduled date and time.

5. LendingKart: Founded in 2014, LendingKart’s primary mission is to make it easy for SMEs (small and medium enterprises) in India to have easy credit access.

It operates as an NBFC, and focuses on the MSME lending and capital space. LendingKart uses big data analytics to help lenders determine a borrower’s creditworthiness. It also completes the loan disbursal process much quicker than the traditional banks.

6. Faircent: Faircent is India’s first RBI registered peer-to-peer lending marketplace where an individual can lend money to a borrower. Their mission is to provide a platform that connects those in need of credit with institutions and individuals who are willing to lend.

Their technology speeds up the process and the borrowers can get the required funds at affordable interest rates. The lenders also get the best possible return on their investment.

7. NeoGrowth: NeoGrowth offers business loans to SMEs and funds small and medium-sized retailers and online vendors in the country.

It has over 6000 registered lenders and 30,000 borrowers. It has an average of Rs. 1 crore loan disbursals every month.

8. InstaKash: InstaKash is a personal loan app that has a simple process when it comes to lending money. It currently offers business loans and lines of credit to small businesses. They have made the application process really simple and fast.

It helps SMEs and self-employed individuals get unsecured loans at fair rates of interest easily.

9. IndiaLends: IndiaLends is a fintech platform whose objective is to reorganize the unorganized lending sector in the country using its underwriting technologies and techniques.

It helps SMEs and self-employed individuals get unsecured loans at fair rates of interest easily.

10. LoanTap: LoanTap is an online platform that provides customised loan products to millennials and underserved audience. LoanTap delivers instant, flexible loans on consumer-friendly terms to salaried professionals and businessmen.

If you are a salaried professional, you can get approved for instant, flexible loans from LoanTap. You can choose, compare and customize loans from various offerings such as a personal loan.

LoanTap helps customers choose, compare and customize loans from an array of offerings such as personal loans, EMI options for loan payments, overdraft facility for individuals, credit card takeover loans, rental security deposit, advance salary and home-owner loans.

How fintech has reshaped the business lending process

The lending market has seen a significant shift from traditional financial institutions to fintech companies providing alternative business lending. Fintech companies are changing the brick-and-mortar landscape of lending by utilizing data and technology. Here are four ways fintech has changed the lending process and how traditional financial institutions and lenders can keep up:

- They introduced alternative lending models: In a traditional lending model, lenders accept deposits from customers to extend loan offers to other customers. One way that fintech companies disrupted the lending process is by introducing peer-to-peer lending. With peer-to-peer lending, there is no need to take a deposit at all. Instead, individuals can earn interest by lending to others. Banks who collaborate with peer-to-peer lenders can improve their credit appraisal models, enhance their online lending strategy, and offer new products at a lower cost to their customers.

- They offer fast approvals and funding: In certain situations, it can take banks and credit card providers weeks to months to process and approve a loan. Conversely, fintech lenders typically approve and fund loans in less than 24 hours. According to Mintel, only 30% of consumers find various banking features easy-to-use. Financial experts at Toptal suggest that banks consider speeding up the loan application and funding process within their online lending platforms to keep up with high-tech companies, such as Amazon, that offer customers an overall faster lending process from applications to approval, to payments.

- They’re making use of data: Typically, fintech lenders pull data from several different alternative sources to quickly determine how likely a borrow is to pay back the loan. The data is collected and analyzed within seconds to create a snapshot of the consumer’s creditworthiness and risk. The information can include utility, rent. auto payments, among other sources. To keep up, financial institutions have begun to implement alternative credit data to get a more comprehensive picture of a consumer, instead of relying solely upon the traditional credit score.

- They offer perks and savings: By enacting smoother automated processes, fintech lenders can save money on overhead costs, such as personnel, rent, and administrative expenses. These savings can then be passed onto the customer in the form of competitive interest rates. While traditional financial institutions generally have low overall interest rates, the current high demand for loans could help push their rates even lower. Additionally, financial institutions have started to offer more customer perks. For example, Goldman Sachs recently created an online lending platform, called Marcus, that offers unsecured consumer loans with no fees.

Financial institutions may feel stuck in legacy systems and unable to accomplish the agile environments and instant-gratification that today’s consumers expect. However, by leveraging new data sets and innovation, financial institutions may be able to improve their product offerings and service more customers.

There’s no doubt that Fintech is here to stay. Its impact on the various facets of finance and business will continue to be felt in the years to come. Case in point is what we have just discussed — business lending. Almost every aspect of it has been a victim of Fintech disruptors.

Fintech has been the much-needed sigh of relief, considering the complications and challenges presented by traditional business lending. As a small or medium business looking for affordable and easily accessible alternative business loans, you stand a better chance of success with an online Fintech lender — particularly those that have been around for a while and have earned a great reputation.

‘Lending is an art not a science’. Do you agree with this statement?

The way the lending function was traditionally carried out made one believe that lending is an art. Lending decisions were more subjective in nature. Mostly these were taken depending up on the gut feeling of lending officers. It was thought that every lending proposal was unique and it was hard to put it in a framework that followed definite rules as are normally seen in a scientific paradigm. However, over the years with the advancement of computer capabilities and statistics, many credit risk models have been developed which have brought objectivity in decision making which is a hallmark of science. Credit scoring models, for example, enable vast numbers of loan proposals to be assessed accurately in considerably less time. The sophistication of techniques available for decision making have removed subjectivity to a great extent and lending decisions can now be taken by use of technology and advanced statistics. Hence, it may be appropriate to regard lending more as a science than as an art. However, despite the modern and advanced techniques, it is not possible to altogether replace lenders judgement, which comes only with experience. Hence, lending still continues to be an art. It is often said that technology helps decision making, but it can’t make a decision, which requires human intervention. Thus, it is difficult to give a definite answer to the above question but modern day lending could be regarded as more science than art.

Lending Trends To Watch in 2020:

The world around us is continuously evolving and the financial sector is not an exception. The digitization is one of the major trends that has resulted in a drastic change in the lending industry. This has encouraged some financial organizations to try new marketing strategies and offer new products to the customers.

Now that banking and financial sectors are moving digital, consumers are receiving better financial products and services. Customer experience and technological advancements are two major factors that drive the change constantly.

Read further to know more about the lending trends and how it would progress

Latest Advancements & Trends

With the latest advancements, the loan processing system has changed drastically and still expected to evolve. The invention of cloud-based payment platforms has helped financial organizations to get better a way lot. It helps with faster and continuous service, up-to-date functions with newer functions, and much more. This has also paved the way to options such as initiation of loans from anywhere anytime through an internet connection.

- Short-term lending to gain pace: You may wonder what “short-term” lending refers to? Short-term lending is already existing in western countries and now started becoming popular in India as well. Pay-day loans or unsecured loans is usually referred to as short-term lending. Lending startups have already started offering these services and mainstream banks are slowly moving towards short-term lending products.

- Paperless system is accelerating: The advancement in FINTECH (Financial Technology) has resulted in a paperless system. With the new Aadhaar verdict, the eKYC procedure has taken a new look. There are several changes in eKYC verification, and few updates are yet to be implemented. As a result of new-age lending systems, the eKYC can be verified online.

- Enhance the digital experience for consumers: Speaking of technology, digitization and automation of lending services have changed the way the people use these financial services. In fact, holding to manual processing will only accelerate the process backward. Going digital not only makes the process flow smoother, but also boosts the overall experience of the consumers.

With clearly defined user-interface, you can have an interactive system that helps your consumers to get the work done in a short period of time. The use of enhanced tools and digital offerings has made the process so simple, that people can easily apply for a loan without even stepping into a financial organization.

Initially, financial processes usually involved a lot of paper-works and mandate a huge amount of storage space. But then, the digital platforms have given a total face-lift. This has changed the lending process and even small-scale financial organizations are providing digital services.

This wouldn’t stop with this. With banks and financial organizations gone digital, India is moving forward to paperless and presence-less delivery of financial services. Further developments and innovations are expected to happen in the customer onboarding space.

Technological Advancements

The technology is progressing and the impact of these technologies in daily life is growing drastically. The year 2019 seems to be a promising year for culmination of some key advancements in lending trends — ranging from blockchain, artificial intelligence to API platform and quantum computing. Below are the biggest trends that would revolutionize the lending industry:

- Role of Blockchain in Lending

- AI-Driven Predictive Banking

- APIs Everywhere

- Big Data Will Change Everything

- Cloud Will Become Omnipresent

- Robotic Process Automation (RPA)

- Provide Richer User Experiences

- Move Towards Digital Presentment

- Automation and digitization will define the mortgage process

- Things will go more mobile

- Use Predictive Analytics

Role of Blockchain in Lending

Blockchain technology is expected to transform the lending industry in several ways — ranging from mortgage loans to syndicated loans. At present, lending transactions depend on third-party intermediaries and include manual processes that are time-consuming and costly.

The invention and rise of blockchain has resulted a boom in financial services. With fintech and blockchain technology, it’s hard to ignore the transformation that has happened in the lending industry. This, in turn, has resulted in loads of opportunities for people who are otherwise shut out of the lending marketplace.

Also, blockchain technology has inspired the invention of several financial services that could significantly change the way everyone thinks about the lending.

AI-Driven Predictive Banking

One of the most innovating and exhilarating trends in 2019 will be the transition towards AI-driven predictive banking. Last few years in the lending industry have made it clear that AI-based banking as a next massive evolution in all the integral sectors of the financial industry. Since banking is one of the most data-driven industry, the role and impact of AI is high and is crucial for surviving the next major data revolution.

One of the major and widespread utilities of using AI-based predictive banking is to enhance client engagement and retention. By using Artificial Intelligence to modify administrative tasks, the employees can concentrate more on building relationships with their customers.

Also, fraud detection can be done in a better way. The boom of this revolutionary technology has unfolded various channels for interactions and communications. This includes web site, mobile applications, and ATM — this has significantly resulted in the elimination of frauds.

APIs Everywhere

Use of Application Programming Interface (API) helps lending organizations to build, configure, and manage their financial offerings, breaking the age-old traditional banking methods.

The emergence of API-based banking has transformed Lending-as-a-Service (LaaS) for all the business organizations that mandate working capital from their bank. With the invention of APIs, lending operations for financial organizations have been transformed to a whole new level. This has enabled several new operational efficiencies within your internal operations. Also, this has dramatically increased your speed to market.

Today with mobile devices taking the prominent place in every individual’s life, new applications are emerging from a wide base. Banking applications have been a great boon as they help people to access their account, get assist from the bank even from a remote location. It serves as an interface between various software programs and facilitates their interaction between the user and the system. This has enabled banking and financial organizations to provide banking services to the customers at their door-step.

Big Data Will Change Everything

Big data is playing a crucial role in major industry sectors, and banking and financial organizations are no exception. For lenders and financial institutions, two factors play a prominent role that drives to success — accuracy and predictability.

Lenders use big data analytics to analyze when a borrower will repay his/her loan or when they are likely to be sent to a collector to repay the money. This shows the difference whether the business is running in profit or loss. With the help of data analytics, the lenders can get a precise output from the stored data.

Fortunately, the emergence of big data in the financial industry is allowing more entrepreneurs to get loans easily. At the same time, it enables banks to remain profitable.

Now, wondering how big data is changing the things? Read further…

More than credit scores, financial organizations have access to more data about the user. Financial organizations usually sanction loans based on the customer’s present credit score. However, a credit score doesn’t tell you clearly about the business idea or its worth. Using more data points provide a clear picture of each prospective customer.

Big data helps in better risk assessment — the key responsibility of a lender is to assess and analyze the risk. When utilized properly, big data helps banks and financial organizations in effective decision making. But with limited information, these projections and decisions are often subjective and unreliable. On the other hand, with more data points, banks will be able to get a clearer picture or risk and reward for potential loans.

Thus, using big data would be of great help for lenders as they would enjoy better insights about the borrowers. At the end of the day, it’s all about better insights on the borrowers that helps in reducing or eliminating the risk.

Cloud Will Become Omnipresent

In the recent years, cloud technology has garnered a lot of interest from the financial and banking industries. The cloud has the potential to completely transform the ways financial organizations conduct their businesses.

As cloud technology is evolving and getting sophisticated more and more, its role in the financial industry is getting evolved. For instance, DBS Bank — one of the largest banks in South-East Asia, has moved a major part, say more than 50%, of its compute workload to the cloud platform.

Now that banks and financial organizations are moving to cloud-based solutions, banks are collaborating with their partners over cloud-based software solution platforms. Software modules could be easily located on the servers of the various service providers and can be utilized for developing a decentralized, cloud-based platform.

Financial institutions are continuously utilizing omnichannel strategies in order to reduce or manage the data explosion. Along with the existing channels, they are likely to make use of the Internet of Things (IoT).

The potential future of omnipresent banking has led to a state of true consistency. This has also led to zero switching costs, zero waiting time, and seamless experience. At the same time, we should be mindful about the security issues and privacy concerns, implementation issues, and much more. But still, there is a huge potential to change the game of lending and make banking and financial services absolutely seamless.

The use of software robots to automate the backend tasks such as documentation, filing and routing, email reminders, and much more is referred to as robotic process automation. When RPA is combined with other automation tools, it would allow for workflows to be built from the beginning to the end.

Lending customers are expecting more and more from the financial organizations and banking industries. They look for instant responses for their queries and expect online portals. To make this all possible, RPA would be the right choice.

RPA enhances the overall operational efficiencies throughout the business via a combination of optical character recognition (OCR), automatic object recognition, and direct application integration. Below are the applications of RPA in lending and mortgage industries:

- Data entry and transfer

- Data compilation

- Workflow management

- Verification and reconciliation

- Routine transaction processing

Leveraging RPA in the lending industry would result in speed, accuracy, and agility to the financial organization. This results in the creation of significant business opportunities that drive great values.

Provide Richer User Experiences

Technological advancements have proven to bring in new and better opportunities than ever for the lenders, which would eventually help them to stay on the top. This would also help lenders to position themselves better in the upcoming years and offer better services to their customers.

Capturing the attention of your customers through rich user experience helps you to gain a strong customer base. Providing room for more services through digital platforms will be an add-on to the lenders.

Rich user experience to your customers can be provided through:

- Expanded payment options

- Mobile-first payment platforms

Providing these two options to your customers helps them to access their accounts as per their convenience — how they want to and from wherever they want. Having a mobile-first payment platform is highly important and reduces the friction that occurs during the payment process. This, in turn, provides better payment options and more user-engagement as well, which eventually results in on-time payments.

Move Towards Digital Presentment

With more and more advancements, lenders as well as borrowers, are moving towards digital presentment. This would help financial organizations to boost their payment processes and to implement new features to the existing system.

With financial organizations moving to digital, lenders can cut-off the paper-works and accelerate the overall payment process. It also makes room for quicker, easier, and safer payment options. Also, opting for digital helps lenders to introduce more features to the lending system including the payment reminder options, payment confirmation through instant notifications, integration of mobile wallet, and much more.

Also, moving lending services to digital payment platforms brings in additional benefits such as user-friendly service, trusted mode for a transaction, and secure payment options for lenders as well as borrowers.

Automation and Digitization Will Define the Mortgage Process

Automation and digitization are set to transform the mortgage industry by addressing a broad range of issues including better customer experience, processing, and overall security issues.

This has helped mortgage lenders to overcome all the issues that usually occur in manual processing. With the industry evolving continuously, retail customers are looking for affordable bank products that do not necessitate the help of banking consultants.

The modern-day mortgage processing optimizes non-customer-facing processes through latest technologies. This results in the delivery of high-quality services and better customer satisfaction. Also, this allows banks and financial institutions to more effectively target their customers with the right offers at the right time.

Therefore, a financial organization that embraces digitization will have better mortgage processing. Automation of lending would help lenders to operate with better capabilities and be flexible to their customers as well. The advancements in the financial industry has resulted in great success, but then, the industry is still expected to evolve with better capabilities.

Role of Mobile Apps

Mobile applications are becoming efficient and they are user-friendly as well. The lending industry is no exception to this. With banking and financial services going purely digital, all the tasks including balance check, financial transactions, paying bills, and all other bank-related tasks can be carried out at a faster pace.

Mobile banking applications are completely safe and secured and include reliable security features. All mobile applications include access PIN or passwords that restrict user access. These apps are secured by several security layers and firewalls.

Thus, increased availability of services through mobile apps boosts the overall user engagement to the bank. This ultimately results in higher revenue.

Use of Predictive Analytics

Predictive Analytics help lenders to modify their lending policies and practices related to market changes.

Use of predictive analytics would help lenders to modify their policies and practices based on the market changes. Now that people and business organizations are completely data-driven, financial organizations and lenders would get the ability to integrate all complex functions together. This includes payment options, platforms, and gateways.

Predictive analytics would help lenders and financial organizations to better understand profit and loss. Additionally, lenders can leverage the stored data to determine the behavior, key characteristics, and gain insights about their customers. It also helps to eliminate bottlenecks in the lending process and provides necessary information regarding payment frauds.

Therefore, implementing predictive analytics in the lending process would help financial organizations in detecting frauds, to analyze profit and loss, and offer better services.

Key Takeaways

The mid 20th century sparked a major shift in how lenders identified responsible borrowers. Instead of family ties or physical collateral to keep lending risks low, the mainstream model shifted to financial data.

- Lending takes place when a lender allows a borrower to borrow something.

- Lending typically occurs in the form of loans.

- Banks and credit unions are the most common lenders, but there are a wide variety of options for potential borrowers.

“Lending eliminates many of the headaches of traditional loans, expediting the process substantially — especially for business loans. Private lenders can get access to customers and offer financing where people and businesses would get turned down by banks because of things like credit scores, not enough time in business, etc.”

To ensure the safety of lending the following factors may be:-

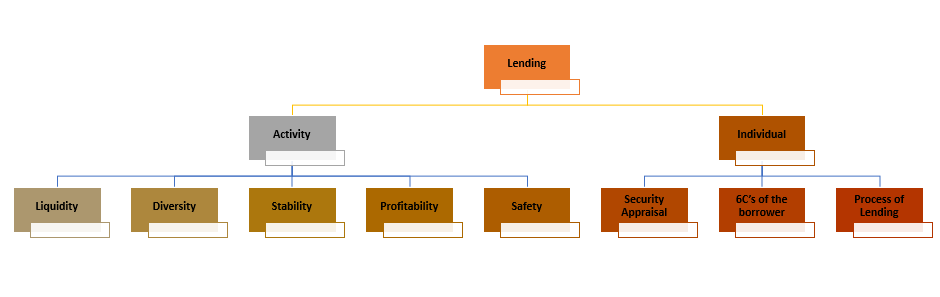

Principle of lending

- The business of lending, which is main business of the banks, carry certain inherent risks and bank cannot take more than calculated risk whenever it wants to lend.

- Hence, lending activity has to necessarily adhere to certain principles. Lending principles can be conveniently divided into two areas (i) activity, and (ii) individual.

The Indian FinTech landscape has led several ground-breaking initiatives and developed innovative models to tackle the longstanding financial challenges of the country. And yet, there still is a huge market with opportunity left untapped. The total value of the digital lending business in India is said to exceed $1 trillion by 2023, of which consumer lending has emerged as an integral part. With availability of loans being limited, and demand for credit being huge — the opportunity area for digital lenders is abundant.

Rapid digitization will enable access to easier, convenient and cheaper credit facilitated by digital lending companies, majority of which currently borrow from informal credit sources. Despite its fair share of highs and lows, the industry is hopeful of a bright and dynamic future. Digital lending and paperless personal loans will further evolve to help a large number of salaried and self-employed individuals in the country.

While technology may appear a novel factor in the online lending space, the online credit platforms will eventually merge with banks, and the latter will absorb their technology and monopolize the market

The fintech revolution has changed the entire interface of transactions in India. Whether it’s payment or insurance or mutual funds or loan disbursement, the entire financial system is linked to technology now.

If you want to know more about other entrants contributing to the “Fintech Revolution in India”, do subscribe to my blog mailing list and checkout my exclusive blog post.

That’s it for now.

Thank you so much for taking the time to read my article! Really appreciate the continued support!

If you have a related query, feel free to let me know in the comments below.

Be part of my FinTech community by subscribing to my blog for more industry content and discussions

Also, share the article with the people who you think might be interested in reading it.

Please leave a comment and share your feedback; it’s what keeps me improving.

Would mean a lot to me and it helps other people see the story.

I look forward to your responses!

Thanks and Regards,

Neha Sahay

![]()

2 Comments

Meetali · December 20, 2020 at 4:11 pm

Hi

Thanks for sharing such a wonderful detailed article on fintech lending. If someone wants to start a fintech company like Lendingtree within India, would it be governed under any regulator or authority of India like RBI ?

Any idea

Thanks

Jamaal · October 7, 2021 at 3:59 am

What’s Taking place I’m new to this, I stumbled upon this I have discovered

It positively useful and it has helped me

out loads. I am hoping to contribute different customers like

its helped

me. Good job.