“Banking’s are necessary, banks are not”- Bill gates

The first wave of the fintech revolution was led by startups focusing on digital payments and lending. Now it’s “Neo-Banks” that are grabbing the attention of both fintech investors and entrepreneurs, with venture capital investments in neo-banks leading the charts of all fintech investments, and a number of neo-banks emerging both globally and in India. That being said, there is a fair amount of skepticism within the analyst and banker communities, as well as the common public, that ‘neo-banking’ may just be a fad which will taper down with time.

It has become a buzzword in the fintech and consumer banking worlds. Also referred to as “Challenger Banking” or “Open Banking”, neo-banking is a craze in both developed markets, such as the US and Europe, and emerging markets such as China, India, Brazil and South-East Asia. In essence, it is a new way of banking, beyond the confines of brick and mortar establishments – one with a compelling digital presence.

Bridging the shortcomings of traditional banking through integrated value chains and regulatory requirements, Neo-Banks today offers a holistic twist to banking services. User-friendly and completely digital, these banks work on referral-based acquisition and competitive pricing.

With no banking license of their own, Neo-Banks partners with traditional banks to offer their service suite. While this might be a pain point, neo-banks target niche micro-segments like the Gen-Z because of their higher transaction volumes. Coupled with Data Analytics, neo-banks bring forth innovative solutions to help individuals keep better track of their finances.

Keep reading to learn why neo-banking is likely to become the next big thing in the world of banking.

India’s Neo-Banks: What’s So ‘Neo’ About Them?

Neo-Banking: History and Origins

The term Neobank first became prominent in 2017 to describe fintech (Financial Technology) based financial providers that were challenging traditional banks. The concept of neo-banking itself, however, emerged years ago, between 2013-15. Some of the first players started up in the UK and Germany, including Monzo, Revolut, N26 and Atom Bank. In India, we at Niyo Solutions were the first fintech to pursue neo-banking back in 2016.

Neobank Fever is spreading around the globe. The term has gained momentum since it’s been taking the spotlight on the news and media. But do we know what it’s all about?

What is a Neobank anyway?

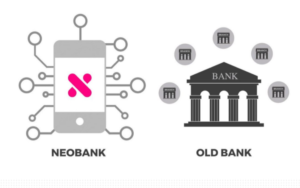

A neobank (also known as an online bank, internet-only bank, or digital bank) is a type of direct bank that operates exclusively online without traditional physical branch networks. Simply put, a Neo Bank is a new type of digital bank that exists without any branches. Neo Banks are reinventing the practices and processes associated with traditional banking.

Neobanks offer innovative features and offerings that are different from traditional banks including fast account opening, free debit card, instant payments, cryptocurrencies, lower costs, mobile deposits, P2P payments, mobile budgeting tools, user-friendly interfaces, etc.

Neo Bank is a new type of digital bank that exists without any branches. They are primarily fintech firms providing digital and mobile-first financial solutions services to modern tech-savvy customers. These include payments and money transfers as well as lending through online platforms and apps. Neo banks are reinventing the practices and processes associated with traditional banking.

Neobanks don’t have a bank license of their own but count on bank partners to provide bank licensed services. For example – Niyo solution tied up with Yes Bank.

Types of Neobanks There are two types of Neobanks.

- One is where the Neobank doesn’t have a banking license themselves and instead partner up with a traditional bank to provide their products.

- Second scenario the neobanks obtain banking licenses themselves to operate fully on their own.

Neobank examples

Although many neobanks look the same with their flashy marketing and fintech angle on money management, there are crucial differences dependent on their licensing structure. Let us define some popular types with examples of each.

With own bank license: Many of the popular neobanks have their own bank license, whether specialized or full-range. With the right license, they can provide their own current accounts, prepaid, debit or credit cards, currency exchanges, cryptocurrencies, money transfers, peer-to-peer payments, savings accounts and loans.

- Examples: Monzo, N26, Revolut, Starling Bank, Atom Bank

Without bank license: Neobanks that offer financial services, but under other banks’ licenses. Customers may already have an account at another bank, which is linked to the neobank service providing their own interface and unique tools to your bank account activities. Tools could be transaction analytics, budget management and automated prompts to help you reach financial goals. Other neobanks may also use a partner bank’s (parent company) license to provide their financial products.

- Examples: Yolt, Simple, Chime Bank

With alternative licenses: Companies that meet the criteria of bank-licensed services, but with alternative licensing e.g. for providing e-money services. Such companies may offer accounts that act like bank accounts, but with limitations that set them apart from full-fledged bank accounts.

- Examples: Monese, PayPal

Beta banks: Subsidiary financial services of a larger, established bank that wants to reach more customers or develop new products under a different brand. Beta banks can provide their offerings under the parent bank’s license and expand to other countries under licenses of partner banks. Services may be limited initially and expand as popularity grows.

- Example: Mettle, Sperbank Direct

How does a Neo bank differ from a Traditional bank?

Over the past few decades, traditional banks have established themselves by dividing their business functions into siloed departments. Consequently, their systems, processes, and culture all function as distinct entities. Traditional banks also rely heavily on a “physical touch model”, meaning feet-on-street sales forces, branches, and other physical distribution channels play a key role in their day-to-day business operations. Neo-banks, on the other hand, have modelled their business on scalable open platforms, similar to Airbnb or Netflix.

Fundamentally, Neobanks are different from traditional banks in every aspect from business models to customer care. Here are some points for Neobank vs. traditional bank.

|

Traditional banks (Product Centric)

|

Neo-banks (Platform Centric)

|

| Time Established | Time Established |

| Decades ago | Within the last 5 years |

| Service/Distribution Platform | Service/Distribution Platform |

| 1) Physical banking platform, brick and mortar model 2) No strong communities around the brand/product 3) High customer acquisition & servicing cost (high touch model) | 1) High community engagement with the product 2) Horizontalization of products with best in class apps, 3) Mobile/digital only distribution and servicing(low customer acquisition cost) |

| Legacy tech infrastructure | Open tech platforms |

| 1)Outdated, non modular tech architecture 2) Hard to integrate with 3rd party service providers | 1) Open architecture technology slack, open banking through API’s 2) Ability to ‘plug and play’ best in class tools/services 3) Open ecosystem allowing access to external developers |

| Product Centric business | Data driven business |

| 1) High Verticalization of products, banking data divided into silos 2)Mix of paper-based and online data 3) Difficulties in reconciling, monitoring data | 1)Real-time data integration and management 2)Data powers business model through 3rd party affiliation fees |

| Product Centric Org designs | Customer Centric Org designs |

| 1) Product centric organizational designs 2) Products and verticals drive P&L organization structure and KPI’s | 1) Customer centric organizational designs 2) Customer segments drive P&L, data architecture and KPI’s |

| Fees/ Charges | Banking License |

| Complex fee structure, recurring fees for many services | Simpler, transparent fee structure, usually freemium model |

| Banking License | Banking License |

| Full, completely regulated | None, partial (digital) or full license, depending on market |

| Traditional banks on the other hand are your brick-and-mortar structures offering you an in-person experience at banking. | Neo banks are fully digital mobile applications (without any physical branches and digital banks are often the online-only subsidiary of an already existing player in the banking sector.) |

| Traditional banks need additional overhead costs (ongoing costs on rents, electricity, etc) which they collect from customers in the form of services like a bank statement, bank alerts, etc. | Neo banks have few costs and they are transparent. |

| Traditional banks a full banking license is a must. | Neobanks don’t have a bank license of their own but count on bank partners to provide bank licensed services. |

| Any approval process (opening account, etc) is lengthy in case of the traditional bank as it is fully manual. | Neo banks make this tedious task automatic and quick. |

| Traditional banks rely on in-person or telephone for customer support. | Neo banks’ customer support relies on a combination of chat-bots and AI providing flexible, virtual |

Here’s Why Neobanks are Better than Traditional Banks:

Now let’s read the pros and Cons of Neobanks.

Pros and Cons of Neobanks

Pros Explained

- Low costs: Fewer regulations and the absence of credit risk allows neobanks to keep their costs low. Products are typically inexpensive, with no monthly maintenance fees.

- Convenient: Neobanks allow you to do the majority—if not the entirety—of your banking through a smartphone app. In addition to basic banking tasks, you should be able to manage your finances and predict activity in your accounts to prevent problems.

- Quick processing time: These tech-savvy institutions allow customers to quickly set up accounts and process requests. Neobanks that offer loans may skip the rigid and time-consuming loan application processes in favor of innovative strategies for evaluating your credit and speeding up the process. For example, SoFi lets you pre-qualify for a loan and see your interest rates within minutes.

Cons Explained

- Requires comfort with technology: If you don’t like keeping up with technology trends, you might want to avoid banking with cutting-edge institutions like neobanks. You won’t be able to take full advantage of the offerings if you aren’t comfortable tapping and swiping your way through brand new apps. Some people enjoy exploring new technology, but if you don’t, neobanks might not be right for you.

- Less regulated than traditional banks: Since neobanks aren’t legally considered banks, you might not have any legal recourse or well-defined processes to follow if there’s a problem with an app, services, or non-regulated third-party service providers. There may be confusion as to who will be responsible for potential fraud and errors. Customers are also on the hook for ensuring that their neobank offers some sort of deposit insurance, such as through the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Share Insurance Fund (NCUSIF).

- No physical bank branches: It’s becoming increasingly easy to do everything online, and neobanks often maintain partnerships with ATM networks, but some people want the ability to visit a branch and bank in person. This is especially true when it comes to complex transactions. While many neobanks offer robust customer service tools, some customers may prefer to ask questions in person.

In other words, Why and Why not Neobanks? These banks offer you easy, hassle-free and 24/7 facilities. Offering a real-time service for services such as payments, balance checks etc, they also give you personalized offerings according to your income or spending habits. Most of all they offer a relatively lower cost structure as no monthly/withdrawal charges are levied on you while offering higher deposit rates than those of the traditional banks.

The key challenges are obvious as a lot of Indians still prefer in-person interaction and branch services while dealing with sensitive information and huge amounts. On top of that, Neobanks still face challenges as far as regulatory requirements and compliance’s are concerned. Currently the market of Neobanks is still developing and is limited to a narrow range of product offerings as well.

Neobanks: How is their service offering different from traditional banks?

Neobanks offer innovative features and offerings that are different from traditional banks including fast account opening, free debit cards, instant payments, cryptocurrencies, lower costs, mobile deposits, P2P payments, mobile budgeting tools, user-friendly interfaces, etc. Here are some of the top innovations happening in this space below:

- Digital Onboarding/Account Opening: Neobanks offer simple and fast online account opening compared to traditional banks.

- International Payments/Remittances: Neobanks offer the usage of their debit card in foreign countries for no fees and at live exchange rates.

- Money Tracking/Account Aggregation: Neobanks can simplify money tracking and account aggregation.

- Lending/Credit Products: Neobanks can provide credit products at lower charges and interest rates compared to traditional banks.

What are the Advantages of Neo banking?

Since neo banks are completely digital, they open up a wide window of advantages to a customer. Here are some key advantages:

- Hassle-free account creation Everyone knows and has gone through the pain that is creating an account in a traditional bank. Sure, this process had become more simplified, but still, the rigidness is not completely gone. Creating an account with neo banks removes this tediousness completely.

As mentioned, neo bank is a completely digital bank, thus eliminating the possibility of a storefront. So, users can create an account without going anywhere. Neo bank functions fully on mobile, making this process comfortable and the account gets ready in a very short amount of time.

- Seamless international payments: With traditional banks, there is always this line differentiating how we transact nationally and internationally. We may need to upgrade the current debit/credit card or get altogether a new card in order to transact internationally.

Neo banks overcome this disadvantage and allow transacting nationally and internationally with current exchange rates.

- User-friendly interface: As mentioned above, neo banking is all about customer experience. This customer-oriented banking facility provides an extremely user-friendly interface that is easy to understand and operate. Neo banking apps are responsive, crisp, and are well designed according to the need of customers.

- Service Speed: Neo bank transactions are real-time and immediate. It provides you a dashboard with an overview of every transaction and up to date balance. It also helps you manage your finances, expenses, and savings and can be customized according to your requirements.

- Lower Fees: One of the disadvantages of the traditional bank is its high operating cost which often comes in the form of charge for services like account statements, transaction alerts, etc. Although things like transaction alerts are important from a security point of view, the average customer ends up paying charges on an on-going basis which adds up to hundreds of rupees in extra fees over a period of time.

Neo banking eliminates this. It operates digitally and makes a wide range of services available for customers with just a few clicks. There is no physical infrastructure, maintenance for physical branches, and ATMs in the case of Neo bank, which saves additional charges. Neo banks offer their basic services free of cost.

Skipping on all the extra service charges, neo banks make themselves a great and promising alternative.

- Value-Added Services: Banking is not only about payment transfer anymore. Neo banks use account information, customer data, patterns, etc. with AI and recommend other financial services for customers as per their needs.

Neo banking application backs up its recommendation with the statistics and insights displayed on the interface.

Neo banks leverage customer profits, recommend services based on demographics, and makes it easy for customers to make their own investment decisions.

- Advanced Security Features: Security is and always will be the most concerning factor when it comes to digital transactions. Neo bank application implements 2FA (2-factor authorization), Biometric verification, RBAC (Role-Based Access Control), encryption technology along with other security measures to protect customer data.

The applications are built to ensure compliance with anti-money laundering laws, complete privacy of customers, and to prevent malware attacks.

Challenges faced by the Neobank:-

- Targeting customer segments

- Arriving at best market-fit product for the customer segment

- Partnership with traditional bank

- Technology challenges – core banking systems used by most banks do not meet some of the expectations for modern digital services

- Narrow range of product offerings; therefore, things like car loans, home mortgages or business services cannot be expected.

- One of its significant shortcomings is that they can’t provide an in-branch service which is preferred by some people whilst dealing with large loans like mortgages.

- Operational inexperience in regards to traditional banks.

- Regulatory and Compliance are subjected to the same set of supervisory requirements which applies to conventional banks.

Ways to set up a Neobank

The neo-banking landscape is an amalgamation of non-licensed, over-the-top banks, digital initiatives of traditional banks, and licensed neobanks.

One of these options is to obtain a virtual banking license from the government and start full-fledged banking services on a mobile app or via any other digital touch-points without any physical branches. Examples of the same are Fidor, a German bank founded in 2009, which has been operating as a neobank in the UK since 2015, or Revolut and Monzo that were founded in 2015 in the UK. However, not many countries have defined their virtual banking policy, which means there has to be another way to do it.

Another model comprises of these companies partnering with existing banks and providing customer relationship services. They offer better user experience and develop various tools that can make the on boarding and transactional experience simpler for customers. As these companies work on a partnership model, the obligation to follow the regulatory requirements is on their partner banks. This is a risk-light model for OTT neobanks. E.g., in lending, the credit risk is borne by the partner banks. Also, partnering with the neobanks helps traditional banks in overcoming the loopholes of the current banking systems along with improvement in the quality of banking services.

How does Neo Banks work?

- Technology: Neo banks primarily rely on the state of the art technological infrastructure, application programming interfaces, mobile applications, artificial intelligence, and data mining techniques. This helps them to achieve instantaneous digital transactions that represent the height of convenience and speed that banking in the digital age promises.

- Collaborate with traditional banks: The working of neo banks does not necessitate having a physical branch. They often collaborate with traditional banks to take care of the regulatory compliance and transactional requirements. This helps all the stakeholders to be benefitted, the bank, neo bank and you (the end-users).

- Working with Local Partners: Neo banks may also team up with local shops to offer last-mile physical presence to facilitate over the counter transactions.

Regulatory norms for Neobank

In India, RBI is still not granting Banking licenses to virtual banks. Currently, Neo Banks are outsourcing their banking responsibilities to those with licencesie creating strategic partnerships with traditional banks.

Focus Business Segment for Neo Banks in India

Neo Banks main focus are especially young generation who are digitally savvy consumers and who don’t want to deal with traditional banks due to lack of flexibility. This generation wants to compare online loans, submit their application with a few clicks, and receive approval in a matter of minutes. And this is exactly what neo-banks offer them: speed, friendly customer support, and relevant services. Neo-banks are all about convenience and respect for the customer’s time. Some of the players are available in both B2B and B2C segments. In terms of customer base Niyo – one of the leading Neo bank has ~ 1 Million customers and B2B leading player Open has ~ 0.4 Million customers. Below are the details of some B2B and B2C players.

B2B companies Product feature offering

Retail companies Product Feature Offering

Funding Details of Indian Neo Banks: –

During the period of Q1’20, India fintech companies has raised $421 M. New-born Neo Bank – Jupiter which is founded by Citrus pay co-founder raised $ 2 M on Apr-20. Below are the more details of Neo Banks funding: –

Neo Banks and their Banking Partners

How do neo-banks stand in front of conventional banks

To say the least, neo-banks are posing a potential threat to conventional banks largely owing to the customer convenience factor which is being built into the DNA of a neo-banking ecosystem. Furthermore, lower capital requirements, flexible government regulations, user-friendly interfaces and continuous focus on innovation has become a differentiating factor between neo-banks and conventional banks. As brick-and-mortar banks march towards perfecting their digital banking solutions, neo-banks offer similar experience sans the hassle of physically visiting a place and getting confused in the complexities of the banking industry.

With neo-banks opening their APIs to third parties, they are empowering cross-category growth as insurance companies and loan providers find their ways to integrate with this digital technology. This very feature will enable neo-banks to grown exponentially as small & medium sized enterprises will begin to expand their footprint through neo-banks.

But why do we even need neobanks? Or What Neo- Bank offers?

- Unique Customer Experience– The customer gets to interact with banking services in a unique and much-improved manner. Neobanks are capable of providing a highly enhanced and personalized customer experience, which the traditional banks famously lack.

- Transparency: Neobanks are transparent and strive to provide real-time notifications and explanations of any charges and penalties incurred by the customer.

- Deep insights: Most neobanks provide solutions with user-friendly interfaces and easy to understand and valuable insights for services such as payments, payables and receivables, and bank statements.

Neo-banks are trying to simplify the ways of transacting through digital mediums through:

1. Simplified process with minimum steps to complete with minimum redirect for the transaction/payment

2. Tightly tying up and different players in the ecosystem (Retailers, Digital Service Providers, Issuer and Acquirer banks, etc.)

3. Standardization across devices and internet browsers

4. Compatibility across platform and technologies

5. Educating conventional customers on digital payment and ensuring that money is safe.

Building a Neo Bank

Summing up the evolving needs of customers, lack of financial wellness support from banks, open banking policies by governments across the globe (discussed later), and the mobile banking revolution — there are still two critical components missing in creating challenger banks: infrastructure and technology. There are two options available in the industry that provide a blended solution to both pieces: Banking-as-a-Service (BaaS) partnerships or direct integration with a bank partner.

Banking-as-a-Service has become a dynamic solution in FinTech to digitally deliver a customer-centric bank into market quickly. BaaS providers have been able to provide a banking infrastructure through APIs (application programming interfaces) that can be implemented and launched in months without monetary licenses (for most use cases) or extensive rounds of capital. APIs can be visualized as Lego blocks that fit together to form a banking core framework — through a series of API calls a user profile and account can be created, and transactions executed. Further customization is then layered on top to set up direct deposit, issue debit cards or credit cards, and process loan applications. These calls are synced to a bank partner that serves as the entity that holds the accounts and funds. Some examples of BaaS platforms are Synapse, Cambr, Bankable, and Treezor.

The second option is a direct-to-bank integration. Multiple banks around the world have opened themselves up to partnerships with fintech companies, or have even developed their own BaaS-type platforms as a separate division. In a similar way, APIs are used to fulfill customer-initiated onboarding, account funding, and other banking activities. The neobank would have greater responsibility in building out compliance, implementation, and end user support when partnering with banks directly. The timeline for approval, integration, and launch tends to be longer as well. Some examples of top banks in this area are BBVA, Fidor Bank, and GreenDot.

There is a less common alternative of a FinTech company gaining appropriate licenses (or national bank charter) on their own, to become an independent bank from the ground up. Some of these pure challenger banks have been able to license their own proprietary platforms to regional banks and other fintechs in need of innovative banking.

Neo-Banking Revenue Model:

Neo-banks operate on a strong cost-efficient model backed by less complex IT systems. So, their revenue model depends on the kind of products and services offered by them. Cross-selling of products/services to niche customer segments also acts as a secondary revenue stream for neo-banks.

They are driven by data-based decisions that depend on a decision-making model. Neo-Banks gather consumer data and analyze them and predict consumer behavior. These predictions help to offer customized services to their target customers. By deploying AI-driven chatbots, video chats, and data analytics, neo-banks are available to customers as a cost-effective banking service right at their fingertips.

Neo-banks cross-sell and generate secondary revenue streams with a range of customized offerings suitable to customer’s needs. They also offer payments and accounts back-end platforms for other fintech companies to build their own interface on top of it.

Plug and Play solutions with 3rd party service providers with ease and data insights. With this, they can offer a range of products and services based on customer appetite and financial goals to boost up the secondary revenue lines and opportunities for cross-selling. Boosting lending options to customers and the SME sector will help generate revenue options.

Growth of neobanks over the years

Neobanking startups have been growing steadily over the last few years. The startup activity in this space started around 2004 and gathered pace after 2011. Credit to GDP Ratio in India is 50% where as it is north of 100% for developed countries. Credit reach definitely needs to improve in India. More bank licenses is surely one way but a thought on giving a systematic push towards digital channels of fulfilling the credit need of the country may go a long way. In India, neo banks are still nascent. Still, they are playing a leading role in helping small businesses to manage finances conveniently and comprehensively. The data below shows that the Indian neo-banking market is growing fast, here are some interesting observations:

- The global neo bank market is growing at a CAGR of 50.6% during the period 2017-2020.

- Around 50% of the startups were founded in 2016 and 2017.

- Before 2010, there were 6 such startups; by 2015, the number rose to 28.

- However, in the last three years, the number of neobanks established has increased to 45.

- Number of neo-banking players in India has gone up in the recent past compared to global markets. There are 16+ Neo Banks in India, and 11 out of 16 are consumer focused. 12 out of 16 Neo Bank are based in Bengaluru.

- Fund raised by Indian neo-banks have gone up to $168 million

- Indian neo-banks are boosting up the competition through value-added services apart from standard offerings.

- Indian Government supports the MSME sector through different schemes that open up Indian SME Neo-banks opportunities.

- ICICI Supports the most followed by Yes bank and IDFC

- Sequoia is the most active investor in Neo Banks

Should you trust neo-banks?

In short, yes. The fact that a bank doesn’t have a physical branch and offers digital-only services doesn’t mean it’s not reliable, in the same way that the existence of a physical branch doesn’t guarantee good customer support or convenient fees. Neo-banks may be new, but they’re a highly regulated industry and companies have to comply with many security and quality standards before they obtain their license. Since they’re online-based, cybersecurity is very important, so neo-banks invest heavily in secure authentication and fraud detection systems.

With the influence of challenger banks growing constantly, consumer adoption is expected to increase exponentially and people from all generations will accept them in the future, not just digital natives. Besides, with online reviews and comparison platforms widely available, it’s very easy to check whether or not a neo-bank is reliable and offers the best terms.

What’s in it for businesses?

Businesses deal with tedious processes involving payments regularly. Neo banks save manual efforts and time at the same time providing useful business insights and financial statements and analysis. In short, they are also of great use for businesses.

No more spending hours and hours with some rigid and complex software’s!

Neobanks are great for businesses, too!

In India, Neo banks are already on the rise and they are disrupting traditional banking models. Becoming the future of banking, their popularity has increased in a relatively short span of time.

Neo banks can play a key role in making India digital and providing customers with detailed, analysis-oriented all in one kind of banking experience.

Accessibility, cost-effective multiple banking, and financial functions are some of the driving factors for Neobanking in India. It may work as an extension of measures in order to solve the challenges of financial inclusion. With initial narrow targets, neobanks can expand its territory by adding more functionality and services in future.

Though neobanks are gathering momentum, most of them are yet to inflict sustained profitability. Nevertheless, they present enormous potential to disrupt banking and financial services. A key to becoming profitable entities could be to convince the traditional banks to invest in modern technologies and develop processes to provide a seamless customer experience.

Neo-Banking in India:

India too is not left behind in the neo-banking arena and the country has seen many such players budding over the last few years.

| Company | Website | Offerings |

| Niyo Solutions | https://www.goniyo.com/ | Salary account, Foreign exchange, Card with savings account, Employee benefits System, Travel loans and Early salary advance. |

| Open Financial Technologies Pvt Ltd | https://www.bankopen.co/ | Automated account, Current account, Payment Gateway Co-branded credit cards, Automated book keeping, Cash flow management, Tax and compliance Management solutions |

| Instafund Internet Pvt Ltd. (Payzello) | https://www.payzello.com/ | Account opening, virtual debit card, UNI cards, Forex cards, Expense management, Loans and money transfer. |

| InstaDApp | https://instadapp.io/ | Smart contracts, crypto currencies, and other blockchain assets deposit account, Decentralized assets lending and borrowing |

| 0.5Bn FinHealth Private Limited | https://www.point5bn.com/ | Banking, credit, payment solutions, and remittance, Goal based savings, consumer durables, Gold health care and government benefits. |

| Forex-kart | https://forex-kart.com/ | Foreign exchange services, Multicurrency Foreign exchange cards, Traveller Cheques |

| Walrus | Payments, Savings and debit card | |

| Neo-Bank | https://neo-bank.com/ | Credit, Savings, and investment products |

| Razorpay-X | https://razorpay.com/x/ | Payments, Current Account, Cheques book, Credit card, Payroll Management , IT and Compliance Management, Customer Relationship Management. |

| Instant Pay | https://www.instantpay.in/ | Targets individual and businesses with savings or current account, Prepaid cards, Bill payments, and collections, Travel, insurance, loans and investments, Expense and cash management Solutions. |

In a nutshell, neo-banking is much more than just a cool mobile interface on top of a traditional bank account. While digital banking (or mobile banking) has been prevalent for at least the last decade or so, neo-banks bring much more to the table. With a differentiated and simplified, yet holistic banking experience, and features that help users build intuition and take charge of their personal finances, neo-banks are changing the way we think about banking. Banking truly can be accessible and user-friendly, and soon, it will be.

- Neobanks are online-only financial institutions.

- Neobanks usually offer fewer products and services than traditional banks, which helps them reduce both institutional risk and customer costs.

- While some neobanks are chartered banks in and of themselves, many neobanks partner with larger, chartered financial institutions to insure deposit accounts.

- Neo banks are clearly the future of banking as we know it. Thanks to their unwavering customer focus, they have been able to carve a niche for themselves in a relatively short span of time. However, traditional banks are not going away anytime soon. By seeking opportunities for collaboration, traditional banks can leverage their scale to bring a digitized suite of offerings to consumers. On the other hand, neobanks can bypass licensing restrictions to innovate further.

- Neo banks are clearly the future of banking as we know it. Thanks to their unwavering customer focus, they have been able to carve a niche for themselves in a relatively short span of time.

The emergence of neo-banks has the potential to fundamentally improve the way people take control of their financial health and meet consumers’ needs better than the industry has ever before — in both emerging and developed markets.

To wrap it up.

The future of the world is digital. Only a few years ago, cashless economy became the financial buzz of the world but with the advent of digital transformation, the financial industry is bound to innovate in many ways. However, it is unlikely that neo-banks will sweep away the conventional banking system which has been around for generations. Traditional banks will continue to digitize their current practices to remain up-to-speed with the development in the FinTech sector and neo-banks will continue to build a promising future for the market and the younger generation of the world.

Thank you so much for taking the time to read my article! Really appreciate the continued support!

Be part of my FinTech community by subscribing to my blog for more industry content and discussions

Please leave a comment and share your feedback; it’s what keeps me improving.

Would mean a lot to me and it helps other people see the story.

I look forward to your responses!

Thanks and Regards,

Neha Sahay

![]()

1 Comment

website · September 29, 2021 at 5:06 am

It’s an remarkable article

in favor of all the web users; they will get benefit from it I

am sure.