“Prepaid cards are a great way to get things done, they’re easy to use and safer and more secure than cash”– LB Camden

Prepaid cards offer the ease and convenience of paying with plastic, but without needing a credit limit. They are useful in a variety of situations. Read on to find out more.

What Are Prepaid Cards?

A prepaid card is a payment instrument where funds are connected directly to a card as opposed to tied to a credit or debit account.

A prepaid card can be loaded with funds to make purchases anywhere a debit card is accepted. It looks like a debit or credit card and is a safe alternative to carrying cash and paying check-cashing fees.

“Prepaid cards allow us to focus on monitoring high-value processes, they allow all Council departments to manage more effectively” – LB Brent

A prepaid card has a zero balance until money is added to it. When you make a purchase with a prepaid card, the amount is subtracted from the balance on the card. Once the balance reaches zero, the card is empty.

A prepaid card is a way to pay for goods and services just like a credit or debit card. The major difference between prepaid cards and credit and debit cards is that prepaid cards aren’t dependent on a link to a savings, checking, or credit account with a financial institution.

A prepaid card lets you load a cash balance ahead of time and use it anywhere your card network — Mastercard, Visa, Discover, or American Express — is accepted. In that sense, it’s very much like a debit card, but without the bank account attached.

With Prepaid Cards You Can:

- Make purchases in person, online or by phone

- Deposit checks.

- Withdraw cash from an ATM or bank,

- Receive wages or funds by direct deposit to the card

- Pay bills online

- Once the card balance reaches zero, it can be thrown away unless it is a reloadable card

How do they work?

Prepaid cards operate in a similar way to normal credit and debit cards except that funds are preloaded onto the cards by the council and then spent by the card holder until the balance is exhausted. As they do not incorporate a credit facility the cards cannot become overdrawn and are not linked to a bank account. Funds can be loaded onto the cards by councils or by their clients at any time. As all transactions are recorded automatically it is possible to track when uploads and subsequent spend take place and monitor how the funds are spent.

How secure are prepaid cards?

The simple answer is that prepaid cards are just as safe as a regular debit card.

- There is no link to your actual bank account, which protects your personal or business account from fraud or cybercrime when you shop online, in-store, on holiday or on a business trip.

- Additionally, each card is protected by a pin, just as a debit card would be. Some prepaid cards offer additional security benefits, such as purchase protection. This protection means that you are financially covered if you buy something online and receive it in a damaged or incorrect condition or if it never arrives.

Types of Prepaid Cards

Prepaid card programs can be divided into two basic types: non-reloadable and reloadable. A non reloadable prepaid card (single-use)is a card to which value cannot be added beyond the initial load (one-time load). A reloadable card(reusable) is one to which funds may be added; it can serve as an on-going financial management tool. This is an important distinction, because whether or not the card is reloadable determines the regulations that govern the card program.

Let’s go through the other types of prepaid cards.

- Open Loop. An electronic payment network-branded card honored wherever the network is accepted.

- Closed Loop. A card used for transactions exclusively at a particular merchant’s locations.

Closed loop reloadable cards can be used for specific purposes or limited acceptance (e.g., fuel cards, movie cards or spend cards such as the Starbucks card).

- Reloadable Cards. A prepaid card that you can add money to.

Also known as General purpose reloadable (GPR) cards are prepaid cards that are purchased by a consumer to be used as the consumer chooses and that can have funds added to the card. The cards can be used anywhere the designated payment brand is accepted or used for specific purposes. The prepaid general purpose (also known as prepaid debit) cards offer consumers the convenience, security and utility of a branded card for a range of needs—from general everyday spending to specific payments or uses. The card provides an easy entry-point into the financial mainstream to underserved individuals who might not have traditional banking relationships, allowing them to pay for purchases and bills, shop online and by phone, or obtain cash at ATMs when they otherwise could not. Prepaid debit cards are also used for things like “bucketing” spending or providing funds to family members.

Examples of GPR cards that are used for specific purposes include cards with limited acceptance (e.g., fuel cards or movie cards); open money and financial services cards that are used for online purchases and offer a full range of services, from savings to bill payment; money remittance/person-to-person (P2P) cards; business travel cards; events and meetings cards where participants are provided with funds for use at the meeting venue and associated merchants; relocation cards; and purchasing cards (cards used by purchasing departments to purchase supplies or other similar items).

- Gift Cards. A non-reloadable card that can be given as a gift and used until the balance is zero.

Gift cards are prepaid cards that have a consumer-defined fixed value and that are given as a gift. These cards can be open (the card can be used anywhere the designated payment brand is accepted), in-store (the card can be used only at a specific merchant), or for distribution (the card can be redeemed at specific locations and offers an experience, such as at a golf resort or spa).

- Teen and Student Cards. Parents can teach teens and students financial responsibility while monitoring their spending with these cards. This type of Cards are also known as Campus cards.

Campus cards are prepaid cards that allow a university or other school to place financial aid refunds, book store refunds and work study pay onto the card. Based on the school’s needs and capabilities, the card may also be used for additional functions such as student ID and meal plans. Students and parents can also add funds to the card for purchases.

Prepaid cards are an excellent way for under 18s to learn more about money and to get used to the experience of paying with a card without the risk of incurring debts.

- Travel Cards. An alternative to cash and traveler’s checks, some cards offer lost luggage reimbursement, emergency card replacement and zero liability.

Transit/Travel cards are closed loop, reloadable prepaid cards and are used to pay for public transportation, with the potential to also pay for transit parking, or other applications. Transit prepaid cards can be funded by a variety of sources.

- Payroll Cards. A card provided by your employer to receive your pay-check.

Payroll cards provide companies a convenient, low-cost method for disbursing salary and wages to employees. For underbanked employees, the payroll card offers valuable benefits by eliminating check- cashing fees and providing a more convenient and secure way to receive and access funds. Payroll cards help employers reduce payroll costs, increase processing efficiency and build employee loyalty.

Employers use payroll cards to deposit employee pay to the prepaid account if the employee does not opt for direct deposit to a bank account or does not have a bank account. An increasing number of employers are also offering payroll cards as a complimentary offering to traditional direct deposit to an existing bank account. This allows employees to be able to segregate a portion of their net proceeds for other purposes (i.e., spending money, additional savings).

- Government Cards. Used by government agencies, they can pay certain benefits such as unemployment insurance.

Government cards are used for the administration of government assistance programs. Rather than mailing a check to the benefit recipient, the federal or state government will contract with a program manager and issuing bank to provide prepaid cards to the benefit recipient. Each month, the agency will transfer the benefit amount to the prepaid card account of each recipient.

Examples of government-funded programs that use prepaid cards include Social Security, Temporary Assistance for Needy Families (TANF), Women, Infants and Children (WIC), state unemployment, and court-ordered payments. These cards can include disbursements for child support, disability programs, pensions, emergency disaster relief, tax refunds, unemployment, benefits, veterans’ benefits, Social Security benefits and worker’s compensation.

Prepaid government disbursement cards offer government agencies a highly efficient way to distribute payments. This prepaid card helps minimize fraud and other costs associated with distributing paper- based payments. The card also provides greater security and convenience to recipients of government payments.

Some prepaid card programs frequently used by businesses include:

- Corporate payments: businesses need to make pay-outs for expenses, incentives, payroll, procurement and many more.

- Employee and contractor expense management

- Gift card programs

- VIP customer pay-outs and rewards

11 Prepaid Categories, 27 Prepaid Market Segments

Open-Loop Versus Closed-Loop Prepaid Cards:

Closed loop cards are an electronic payment card that can only be used with a specific payee. Generally, electronic payment cards can be either closed loop cards or open loop cards. The issuer creates a private card that can be used only on their private network.

- Merchants issue closed loop cards for customers to use in-store or on-line as a form of debit or credit card.

A closed loop card is only valid for use with the single company that issued the card. - Closed loop cards require lower processing costs for merchants, typically.

- Closed loop cards do not offer as much flexibility as other cards.

- Closed loop where cards can only be used at a single or defined set of merchants.

By contrast, an open loop card is a card type more commonly associated with all kinds of standard transactions. An open loop card can generally be used anywhere the card brand is accepted, like Visa or American Express. Open loop or cards that can be used at any merchant accepting that card’s payment brand

Prepaid Card Features

There are many prepaid cards out there, and choosing the right one is important. What features are most important to you?

- Reloadable Some prepaid cards allow you to add money once the balance reaches zero. Gift cards are not reloadable.

- Liability Protection Some prepaid cards will protect your balance in case the card is lost or stolen. Look for a card that offers a zero-liability policy.

- Expiration Dates While many cards do not expire, some carry monthly maintenance fees, which can reduce your card balance. Prepaid cards are best for storing money you intend to spend in the short term.

- Low Fees Is there an activation fee charged when you set up the card? What are the fees charged for ATM withdrawals? Take note of any fees associated with the card you choose.

Reasons to Get a Prepaid Card/ Advantages:

While they work in many ways like a typical debit or credit card, prepaid versions offer certain advantages over these other forms of payment.

- No bank account needed: Users of prepaid cards do not need to have a bank account. The cards are pre-loaded by the issuing party and the user can receive and use the funds without linking them to a bank account. This is an advantage as the unbanked population can access the benefits of a credit or debit card. What’s more, the fact that the card can only be used if loaded, limits the risks involved in lost or stolen credit and debit cards.

- Anonymity: Prepaid cards can be issued without a cardholder name on them. Cardholders prefer payment privacy in certain situations.

- Widespread use: Prepaid cards are widely accepted and they have even more acceptability than credit cards in some cases. As they are associated with one of the major card networks, like Visa, MasterCard, Discover, American Express, they can be used anywhere those cards are used.

- Prevent overspending: Prepaid cards can be a great way to stay out of debt, since you can’t spend more than the amount you already deposited. It’s also a nifty budgeting tool. Even if you have a checking account, you can put a fixed amount on your prepaid card for certain spending categories, such as eating out. When your allowance for the month dwindles, you’re forced to do a little belt-tightening.

- Avoid overdraft fees: Banks have no problem with slapping customers with steep penalties when they overdraw their checking account.Some banks let you turn off overdraft protection, but it may be easier still to get one of the many prepaid cards that never charge these fees.

- Limit losses: You can’t lose more than the balance on your prepaid card, even if you become the victim of fraudsters. If you use a debit card instead, its liability protection likely has you covered, but some consumers prefer using their prepaid card when making an online or in-store transaction, rather than putting their full checking account at risk.

- Best cards for bad credit: Despite poor credit history or low credit score, it is still possible to get the prepaid card.

- Various features: Besides the basic ability to make purchases with a card, prepaid cards offer some other features. This kind of card can be used to get instant cash from almost all the ATM’s and the transactions are secure as every such card is PIN-protected.

- Reloading is simple: In case you need to put more cash on your card, you should just make a transfer of money from a bank account or financial institution.

- Easier way to manage your money: When the money is run out, your spending stops automatically and you can’t get into debt. The activity and usage of your prepaid card can be tracked online or by using your phone. This makes it very easy to control all your spending, generate and keep records.

- Protection in the form of daily limits: You can set daily spending limits or even limit per purchase. This will be helpful in keeping the damage minimum when you accidentally miss the card or if the card is stolen.

- High level of protection: Prepaid cards offer the same theft and loss protections as a credit card. If you report the loss or theft of a registered card to the issuer, most will restore your balance and give you a new card. There is no need to worry about card fraud or identity theft, a card of this type could be a good option as they are not linked to your bank account and are PIN-protected.

- Global usage: prepaid cards can be used anywhere where the card network they belong to can be used globally. For example, prepaid VISA cards can be used anywhere that VISA cards are accepted. Although many cardholders and merchants wonder what country of issuance means in terms of limitations when a prepaid card is used, the same limitations apply to a card whether it is a prepaid, debit or credit card. Country of issuance refers to the country in which a prepaid, debit or credit card was issued. In certain situations, for example in travel, merchants prefer that local cards are used as a way to mitigate risk and foreign exchange exposure. Or in certain geographies, transactions get declined by default if local cards are not used to make purchases online.

Disadvantages of Prepaid cards:

So you have seen the advantages that prepaid cards can give you, however they must be weighed against the disadvantages.

- Prepaid cards are not considered a form of credit, so it is impossible to build credit history by using them. You should understand that even though prepaid cards are bearing a credit card company logo on them, they are not credit cards. You are using your own deposited money instead of borrowing it and paying it back, so credit function is not available.

- Prepaid cards charge a lot of fees. Your prepaid card may charge these fees such as- Initial setup fee, Monthly maintenance fees, Fees for using an ATM, Fees for reloading money onto the card, Fees for checking your balance. You might have to pay every time you use the card or speak with customer service. Some Prepaid cards charge monthly maintenance fees as well. Prepaid cards cannot help you build a strong credit history. While using prepaid cards, you are not using a line of credit and don’t need to pay a monthly bill to repay a debt. Your activity is not reported to credit reporting agencies.

- No savings: Prepaid cards make it easy to spend money; it’s hard to save money unless you have a bank account. If paying a few extra money in bank fees means you’ll accumulate savings throughout the year even if it’s just a mental trick to get yourself to save it’s probably worth the cost.

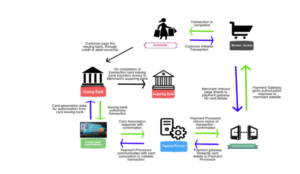

Processing payments from Cardholder to Acquirer:

Card payments are a commonplace now. Most of us use plastic to pay for various goods we buy online or at the retail stores. But not many really understand what happens behind the scenes when you swipe your card at a card machine (PoS) or why is it that your refunds take so much time.

There are a number of different parties involved in a basic eCommerce transaction. These parties essentially connect the buyer (cardholder) and the seller (the store owner) to make the money transfer possible between buyer account and seller account.The process is surprisingly complex, despite the fact that it takes only 2–3 seconds on average:

- Cardholder: Makes a request for a purchase from the merchant, enters and authorizes cardholder information to initiate the transaction.

(The individual consumer owning the card and responsible for paying the card account. The Cardholder uses the card to pay for goods and services, and pays cash to the Issuer upon receipt of the card account statement.)

- Payment Gateway: Forwards transaction information directly from cardholder’s web browser to payment processor.

- Processor: Serves as a facilitator on behalf of the acquirer, forwards transaction information from the payment gateway to the card network.

- Card Network: Routes the transaction information to the correct issuing bank in order to receive the bank’s authorisation.

- Issuer: Receives and verifies the transaction information; if the credit or debit is available, the issuer sends an authorisation code for the transaction back to the card network.

- Card Network: Receives the authorisation approval from the issuing bank, then forwards the authorisation to the processor.

- Payment Processor: Receives the issuer’s authorisation approval from the card network, then forwards that information to the payment gateway.

- Payment Gateway: Receives the issuer’s authorisation approval from the processor, forwards it to the merchant to complete the transaction.

- Merchant: Receives the authorisation, fulfils the order, and batches the transaction information along with the rest of the day’s sales.

(Merchant is a business that sells services or merchandise and accepts credit cards as payment, and the Acquirer is the bank through which the Merchant has its merchant account. For the Cardholder to do business with the Merchant, the Issuer and Acquirer must belong to the same Interchange Association, such as Visa or MasterCard.)

- Acquirer: Receives the batched transactions at the end of the day, then deposits an amount into the merchant’s account equal to the total of the batch, minus applicable fees

(The bank through which the Merchant has its merchant account. Upon settlement of a transaction, the Acquirer deposits funds in the Merchant’s bank account. This may NOT be a brick-and-mortar bank. The Acquirer’s revenue comes from the difference between the merchant discount and an interchange discount paid to the Issuer. The Acquirer is at risk if the Merchant defaults on refunds or chargebacks. Most major banks act in an Acquirer role. The Acquirer holds the formal “Merchant Agreement” with the merchant, and is also responsible for enforcing PCI Security mandates.)

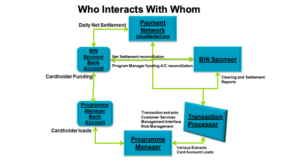

The Prepaid Card Value Chain

Continued growth of prepaid business has led to consolidation and maturity. Prepaid card programs have had complex value chains that have put pressure on the margins of programs because a variety of companies need to share the revenue in order to make a prepaid card program function.

Margins in prepaid are thin, and there can be seven participants in the prepaid value chain that directly drive both revenue and cost. The more roles a single entity can take on, the more profitable the card program.

Here,

Acquisition Point -refers to Retail Outlets Websites Mall Etc.

Service Providers refers to Help Desk, Rewards Bill Pay Reload Etc.

Issuing Processor refers to First Data, Fidelity, eCommLink,I2C, FSV Etc.

Issuer refers to Meta The Bancorp Bank, Citi, JPMorganChase Etc.

Payment Networks— refers to AMEX, Discover, MasterCard and Visa,

Roles of Participants in Prepaid Programs:

- Cardholder: Loads the funds

- Distribution — retailer or bank / FI or program manager online

- Program/Product Sponsor — bank issuer or bank issuing partner that manages the programs

- Issuer — bank issuer for cards

- Issuing Processor — card processor

- Networks — AMEX, Discover, MasterCard and Visa, PIN Networks

The role of a card network is to facilitate transactions between merchants and card issuers. To do this, card networks create virtual payment infrastructures and charge merchants interchange fees for processing consumers’ credit or debit card transactions.

- Acquirer — facilitates processing with ATM and POS

- ATM/POS — provides cardholder with access to funds at ATM, cash advance in a branch or via POS (retail, web, telephone, etc).

Now let’s quickly look at how these parties are connected in the payment chain and what roles they play in processing a card transaction request.

- When you finalise on the items you wish to purchase and decide to pay using your card (either at the PoS machine or at the payment gateway), your card details are first collected by the PoS machine or the payment gateway. This information along with the authentication information passed (card pin/ OTP/ 3D secure password etc.), the transaction amount and the merchant details, is passed on to the acquiring bank.

- The acquiring bank checks the card details to confirm if this an On-us or Off-us transaction. An on-us transaction is the one where issuing and acquiring banks is the same and hence there is no need to involve the payment network for inter bank communication.

- If it happens to be an On-us transaction, the acquirer checks the incoming information to validate a) if the authentication information provided by the user is valid i.e. if the user is able to prove his identity by providing a correct pin/password b) if the cardholder’s account has enough funds required for the transaction c) if the card is not blocked or expired. These things are primarily checked among other details. Once all details are validated, the acquire approves the transaction and the same is communicated back to the merchant terminal (PoS/ Gateway).

- If the transaction is an Off-us transaction, the acquirer passes on the transaction and card information to the network. The first six digits of any card number (i.e. the 16 digit numeric code printed on the front side of every card) can be used to identify the issuing network and the bank. This number is called the Issuer Identification Number (IIN) or the Bank Identification Number (BIN). Basis the card BIN, the acquirer sends the transaction to either of the networks (Visa, MasterCard, RuPay etc.).

- The network identifies the bank to which it has issued a particular BIN, and routes the transaction and card details to that bank.

- The issuing bank then checks the information to validate a) if the authentication information provided by the user is valid i.e. if the user is able to prove his identity by providing a correct pin/password b) if the cardholder’s account has enough funds required for the transaction c) if the card is not blocked or expired. Once all details are validated, the issuer approves the transaction and the same is communicated back to the payment network.

- The payment network sends the authorization from the issuing bank back to the acquirer bank.

- The acquirer bank sends the authorization further to the merchant via payment gateway or the PoS set up to complete the transaction.

Though, it might seem like a long process, all of it happens real-time (barring a few exceptions) in a span of a few seconds. The acquirer’s payment processor facilitates the flow of information between all these middlemen.

All these intermediaries primarily operate on a revenue sharing model. For every transaction, there is a transaction fee usually varying between 2 to 3.5% called the Merchant Discount Rate (MDR). Out of (say) this 2%, a major share (1.7%) goes to the issuing bank and is referred as the Interchange Fees, around 0.1% is shared with the network as Assessment Fees and the remaining 0.2% is retained by the acquirer. Payment gateway adds its own Processing Charges on top of the MDR. In addition to these, there are other minor fee components charged and shared in the entire value chain.

Revenue Share Potential

For any prepaid program, the issuer, program manager, and processor must cover their own implementation costs so that the agency can enjoy a sustainable revenue share. Components of a revenue share typically consist of a percentage of some or all of the following:

- Spend or load amounts

- Interchange (for network-branded transactions)

- Fees

- Float

The success of any program depends on the number of cards distributed, the amount of funds loaded and redeemed on a card, the ability to introduce cardholder fees, and the amount of time (number of months and years) a patron uses the card. A healthy revenue share is also directly related to the amount of support the prepaid manager receives from the agency in distributing and encouraging the use of the card.

Why Financial Institutions Are Considering Prepaid As a New Revenue Stream

- Loss of Overdraft Overdraft programs helped pay for the “free” checking accounts, but these fees have largely gone away. This is forcing banks to look for new sources of revenue.

- Loss of Debit Interchange: Prepaid cards may become more attractive as a debit alternative.

- The End of Free Checking: Low-margin accounts may not be worth keeping if they do not produce any steady source of fee income. This means banks might use prepaid as an account substitute.

Prepaid Cards and the Issuing Bank

By definition, an issuing bank is a bank or financial institution that issues debit and credit cards to consumers or merchants. Through a card issuer, individuals or businesses can get credit, debit or prepaid cards from the most well-known card networks like Visa, Mastercard, and American Express. The credit card issuer acts as the middle-man between the consumer and card schemes like Visa and Mastercard. The card schemes have ultimate control over cards that bear their logo, but the issuing banks do a lot of the legwork…and take on much of the liability.

The responsibilities of the card issuer: They provide banking services to customers, allowing individuals to initiate purchases using payment cards.

What is the role of the issuing bank?

The primary role of an issuing bank (also known simply as an issuer) is to provide payment cards to consumers on behalf of the card networks. This financial institution acts as a liaison and facilitates the repayment of transactions to merchants.

Most issuers supply cards branded by Visa or MasterCard. However, American Express and Discover are both card networks and issuers, meaning they supply their own branded cards directly to consumers.

Some financial institutions, such as Bank of America, represent both merchants and cardholders, and can therefore serve as both an issuer and an acquirer at the same time.

Even though some people might think that Visa and Mastercard are issuing a cardholder’s credit or debit card, that’s actually an action performed by an issuing bank. The reason for this is that the risk involved in such a process requires the bank’s involvement to underwrite risk. For instance, when a cardholder disputes a chargeback due to a suspicious transaction that appears on their card statement, it’s the issuing bank who will decide if the chargeback will be processed or not. Or, in another case, when a cardholder doesn’t have enough funds in their credit card to complete a purchase, the issuer contacts the customer and not the card network (e.g. Visa, Mastercard) to resolve the issue.

A typical transaction starts when the cardholder uses a payment card for a purchase. After the customer submit his or her transaction:

- Card information is sent from the merchant to the payment processor.

- The processor submits the request through the card scheme, then on to the issuing bank.

- Issuing bank checks whether the card account is active, whether the requested amount is available to the account, and more.

- The transaction is either authorised or denied, with the decision being transmitted back the way it came, from card scheme, to acquirer, to merchant.

- The merchant sends batches of authorized transactions to the processor, and eventually funds are transferred from the cardholders’ accounts to the merchant account.

There are several reasons and benefits for opting to leverage an issuing bank’s prepaid card program for pay-outs in business:

- A more economical and speedier alternative to high-cost banking solutions

- Improved efficiencies in processing corporate payments

- Increasing the reach of those businesses can make pay-outs to, such as making payouts to the unbanked segments, or customers that strongly prefer payment privacy.

- Leveraging branded prepaid card programs to drive brand awareness and customer loyalty

- Reduction of payroll costs

The parties involved in a card transaction

When issuing the card, the card issuer establishes the required infrastructure. The acquirer ensures that merchants can accept card payments. The issuer, acquirer, and credit card organizations are all involved in payment processing.

What does the issuing bank do?

The issuing bank .

- issues the card to the user as a financial service provider.

- settles payments made by the cardholder with the acquirer of the merchant.

- is funded by fees paid by the cardholder and the acquirer.

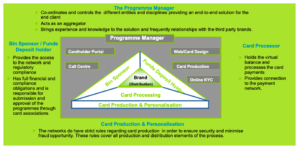

Elements of a Successful Card Launch Program: Strategy, Product Design + Enablement Partners

Enablement partners in the card issuance program:

There are five partners in the enablement value chain

- Program managers may offer services such as program oversight products, marketing, operations and customer services

- Issuer Processors help connect your card to the payment network and offer services such as card fulfillment, fraud management and settlement

- Payment networks such as Visa enable card acceptance between banks and merchants worldwide both online and in person.

- Load networks support the prepaid payments category specifically the Visa prepaid load network enables consumers to add funds to their prepaid accounts through mobile apps or at merchant locations.

- Bin sponsors a bank license to issue visa cards and support your program. The bin sponsor also ensures compliance with local regulations and Visa rules and it can act as a settlement agent for various partners in the payment ecosystem.

Let’s understand each partners roles and responsibilities in details.

Participant Roles in Network-Branded Prepaid Card Programs:

The prepaid business model is structured differently from the business model in the credit or debit card industry. This section discusses the different parties that are involved in a major network-branded, reloadable prepaid card program and their roles in the process.

The issuer is accountable for all aspects of the program, compliance with all applicable Federal and state regulations and laws, and compliance with the payment brand’s rules. The issuer has approval authority over most aspects of the program. The payment brand considers the issuer to be the liable party behind the program. Subject to the payment brand’s rules, the issuer must approve all parameters of the program, including (but not limited to) maximum card balance, maximum daily transaction balances, number of periodic reloads, cardholder fees, and marketing.

The program manager is the driving force of execution behind the prepaid card program. Typically, the program manager designs the program and develops the business and marketing plans. The marketing plan includes a distribution strategy and a network of distributors. In conjunction with the issuer, the program manager sets the pricing and fees for the product. Program managers use their expertise in the market to develop alliances with strategic business partners and third-party vendors. The program manager must be registered with the payment brand as a member service provider for the issuer.

The payment brand sets the rules that must be followed by all parties involved in the transaction; the rules are typically defined in each payment brand’s operating regulations. The payment brand also standardises information about the components that reside on the card. From a transaction standpoint, the payment network and associated brand (i.e., American Express, Discover, MasterCard or Visa) are responsible for the authorisation, clearing and settlement associated with open loop network use of the card beyond just transactions in the transit environment, in addition to supporting interchange between the acquirer and the issuer. One activity performed by the payment brand organisation is to review and approve the card program submitted by the issuer. The payment brand supplies and configures the card program’s bank identification number (BIN) and is available to assist with program and product consulting and marketing initiatives.

The processor is a member service provider (MSP) registered by the issuer to perform processing services. These services include the development of a platform for configuring and supporting the card program, performing cardholder customer service, acting as the system of record for prepaid accounts, facilitating authorisation and settlement, providing reports to the issuer and program manager to manage the program, managing the interface to the payment brand’s network, and implementing fraud and data security controls. The processor must be compliant with the Payment Card Industry Data Security Standard (PCI DSS, a set of standards designed to maximize data security). The processor and the program manager could be the same entity.

The load network provides a channel by which cardholders can add cash to their reloadable prepaid cards through a network of retail locations. While there are a number of pricing scenarios in the market today, the load network essentially charges the cardholder a fee (in some cases set by the merchant) for conducting a cash load, similar to the fee that ATM providers may charge on a transaction conducted at one of their ATMs. There are also additional revenue-sharing opportunities associated with cash load transactions. The initial load cost is included in the purchase price of the card, but for subsequent reloads, the load network charges the cardholder a fee and pays a portion of the fee to the merchant.

Roles and Responsibilities

- Card Brand Payment networks such as MasterCard, and Visa (and others) that act as gateways between acquirers and Issuers for authorizing and funding transactions made using prepaid cards bearing their brand. The Card Brands issue rules and regulations applicable to Issuers and acquiring (merchant) banks that participate in their card programs.

- Program Manager A Program Manager is a non-bank entity that contracts with an Issuer to establish, market, and operate prepaid card programs. Typically, Program Managers are responsible for establishing relationships with Processors and Distributors.

Definition: The program manager runs the card program on behalf of the issuing bank. The program manager is responsible for:

- Program definition and strategy

- Card operations and support including fraud prevention

- Cardholder customer service

- Cardholder website, IVR

- Plastics design and procurement

- Card mailers/ marketing collateral design and procurement (including terms and conditions)

- Initiating and monitoring chargebacks

- BSA(Bank Secrecy Act)/AML(Anti-Money Laundering) compliance (on behalf of the issuer)

- Card marketing and sales

- Relationship with issuing bank

- Relationship with transaction processor

- Handling sales partners’ commissions

- Fee structure and Program P&L

Program Manager decisions to be made:

- Type(s) of card program-gift, General reloadable, Payroll, travel etc.-each type of card may require a unique BIN (bank identification number)

- Issuing Bank(s) and Processing partner

- Plastics providers

- Distribution and marketing channels to be used

- Card network (Visa, MC, Discover, AMEX or private label)

- ATM networks (STAR, NYCE)

- Load networks (How are cards reloaded?)

- How will cardholder support be handled?

- Financial model-How will the program make money?

The Prepaid Card Issuing Structure

There are three key roles within the prepaid card structure each with their own responsibilities plus the programme manager.

- Coordinates and controls the different entities and disciplines providing an end-to-end solution for the end client

- Acts as an aggregator

- Brings experience and knowledge to the solution and frequently relationships with the third party brands.

- Issuer : An entity, which is typically a bank, that issues prepaid cards to a Cardholder. Also called the issuing bank. The Issuer must be licensed by the Card Brand to participate in their card programs. The Issuing bank is the official program owner with ultimate responsibility for program risk

Issuer responsibilities include:

- Member of the CardAssociations/ (Visa, MC, Discover, AMEX)

- Due diligence, audit and oversight of other channel partners

- Approving new programs and submitting program paperwork to Card Association

- Applying for program BINs

- Providing ABA routing(the unique nine digit number used to identify the paying financial institution in a payment transaction) number(s) and pseudo DDAs for direct deposits

- Regulatory compliance, OFAC, AML etc.

- Brand standards compliance

- Maintaining program bank accounts and program settlement

- Monitoring for fraud and program negative balances

- Processing SARs, CTRs and other finCEN/ Government reporting

- ACH(Automated clearing house) processing(sometimes this is done by another bank)

- Relationship with ATM networks

Issuer decisions to be made:

- Financial model-which program managers to work with/ how will the program make money

- New BIN or segment of current BIN

- Card network to recommend

- Transaction Processor A Processor facilitates payment transactions for prepaid cards. “Core Processing Services” usually include card account set up and card activation; provision of authorisations for card transactions; value load and reload processing; and security/fraud control and reporting. Processor services often also include Cardholder customer service (telephone and Web); chargeback processing; Cardholder error and dispute resolution; periodic Cardholder statements; and provision of settlement services with the Card Brands.

- Issuing Transaction processor –Processor responsibilities include:

- a.Platform for defining program settings, fees and parameters

- b.Processing cardholder transactions

- c.Settlement with Card and ATM networks

- d.Fraud parameters

- e.Cardholder card account statements

- f.Storing cardholder transaction data

- g.Processing chargebacks

- h.Cardholder customer service (if contracted)

- i.Sending track file data for new card generation to plastics vendor

2. Acquiring Transaction processor-Processes credit card purchases of and loads to prepaid cards

There are a number of key responsibilities that each of the programme components have jurisdiction over:

- Distributor/Marketing partners: An organization that markets and distributes prepaid cards. The Distributor typically has a contract with an Issuer or a Program Manager. Examples include a retailer or bank selling gift cards or general purpose prepaid cards, an employer offering payroll cards to employees, or an employee benefits company offering cards to plan beneficiaries. Distributors include banks, employers, companies and other referral sources. Can be retail vendors, independent sales organizations, corporate partners, or basically any company that has been contracted to sell the prepaid card.

There are several methods for distributing prepaid cards to consumers. Typically, cards are distributed by the issuer or merchant (or transit authority) or through national third-party distributors. Specific distribution methods include:

- J-hook sales at merchants or financial institutions. These are retail displays that present prepaid cards in packaging that hangs from a hook that is shaped like the letter “J” to allow easy selection by the consumer. These are often combined in a retailer’s gift card mall displaying several types of cards. The package is typically taken to the check-out counter where the clerk accepts payment, activates the card and loads the initial value.

- Cardholder mailings to registered consumers. The preferred method for distribution to an existing customer base is by mail.

- Issuance by employers, universities, and other organizations. In certain cases, program managers can enable other parties to activate cards at the time of sale. Issuance may also include equipment to add pictures to the card for other purposes.

- Internet / mail / phone order. Many program managers offer consumers the ability to purchase cards online and have them mailed to the purchaser’s home or business.

- Kiosk sales machines. Self-service kiosk sales allow consumers to insert cash into a slot and receive an activated card for the amount presented, less any initial fee. These machines offer a simple interface and multilingual capability and are similar in construction to ticket vending machines in transit.

- Cardholder The owner/user of the prepaid card. This may be the card purchaser (e.g., general purpose spending card) or card recipient (e.g., gift card, payroll card).

- Third-Party Agent :Depending on the card type and program structure, other non-bank entities also may be third party agents that provide additional services related to the value chain Such as – Statement/Invoice Production, Letters Production (MS Word supported), Electronic Funds Transfer Interfaces (ACH supported),Plastic Card Production(Card printing), Host Security Modules, Loyalty Redemption, Reporting Tools (Crystal Reports & SRS-Microsoft),Credit Bureaus,Interactive Voice Response, Dialers, General Ledger System.

Plastics vendor responsibilities include:

- Plastics printing, storage and embossing

- Mailers and collateral

- Sending plastics to cardholders

Prepaid card programs are different, from the players involved to the Brand association rules to the cardholder behaviour. Despite several high profile IPOs recently, the prepaid marketplace is still highly fragmented. The players are generally smaller, and each has unique strengths and weaknesses. As the prepaid market grows more and more complex, value chain participants become more and more difficult to assess as potential partners.

Regulatory Issues That Affect Prepaid Cards: Prepaid Cards Regulatory Landscape

- Dodd-Frank Act & FRB Implementation — a)Reduced interchange on debit (if not exempt) b)Limits fees charged on prepaid cards (to remain exempt) c) Requires Dual Routing (All, Except Three Party Networks)

- OCC( Office of the Comptroller of the Currency) Guidance on Managing Prepaid Risk —a)Defines process banks must follow to manage prepaid risk b) Requires bank to document and control all processes c)Will likely require capital reserves sufficient to cover risks d)Program Managers will likely find costs become related to risk, causing partner re-assessment

- FinCEN(Financial Crimes Enforcement Network) Prepaid Instrument—a)Restrictions on load values and international & P2P access b) Contractual changes to define “Provider of Prepaid Access” c) Proposal to require Prepaid Instruments be declared as Monetary Instruments at border crossings

- Consumer Protection Actions —a)Consumer Financial Protection Board b)State Attorney Generals (Florida Investigation) c) Outcome of the investigation could lead to states targeting prepaid d)Could cause public to respond negatively to prepaid

Important Factors in Evaluating Prepaid Programs

- Prepaid is a volume business.

- Distribution is a key element to success, channel conflict ahead.

- High volume portfolios are aligning Value Chains.

- OCC( Office of the Comptroller of the Currency) Guidance will drive consolidation as partner risk must be accounted for in reserves.

- Technology, including Mobile and Social Media as a distribution and customer acquisition play, will drive continued rapid evolution of this industry.

- Regulatory action is the largest risk to the industry.

Key Takeaways:

- Prepaid cards are a form of debit card where you spend money you’ve already loaded onto the card. In other words, a prepaid card is a convenient mode of payment, and it requires very little time or cost to get one. Prepaid cards, in addition, to be an alternative to cash, offer security and greater ease of transaction to consumers. Owing to the increasing penetration of smartphones and internet, India has witnessed significant growth in the e-commerce industry in the last decade, which has catalysed the growth of online payments using prepaid cards. The growth has also been driven by demonetisation and the government’s encouragement towards a cashless economy. In addition to this, increasing number of organised retailers has also contributed to the growth of the prepaid cards market in India

- While prepaid cards are catching on among “unbanked” consumers, some individuals use them in tandem with a checking account to limit their discretionary spending.

- Issuers may charge setup, reloading, and purchase fees — in addition to a fixed monthly fee. It’s a good idea to understand exactly what those charges are before buying a card.

- Prepaid payments come with a variety of product capabilities,involving a range of parties and functions

- Prepaid payments offer unique access and features to individuals, businesses and governments who are increasingly reliant on such products to make efficient and securepayments in the current economy

- Prepaid payments keep consumers “on the grid” and are vastly superior, from an AML prevention and deterrent perspective, to paper payments and cash.

Full Back Office Functionality

Prepaid cards present unique offerings and target specific customer segments/ industry processes that are in need of simplicity and cost effectiveness.Prepaid cards, in addition to being an alternative to cash, offer customers safety, security, and greater ease of transaction. Most notably, these products propagate predictability and discipline, which enable consumers to limit spending and encourage budgeting. Prepaid cards offer a payment tool, especially for those consumers with no credit history, or a bad one for that matter, and ensure financial inclusion for the unbanked population.

With prepaid players introducing sophisticated features, the boundaries between prepaid cards and other banking products are expected to blur. Mobile applications offered by prepaid players further shadow these boundaries and offer a dynamic banking ecosystem.

The prepaid segment is expected to grow exponentially by 2022, with the US market touching US $ 3.1 trillion. In order to have a share in the pie, prepaid providers should continue evolving and innovating not only from a technological standpoint, but also from a consumer standpoint and redefine the way the prepaid product is perceived by the public.

The Prepaid Cards Market in India (2014-2023) is projected to grow from $38.6 Billion in 2019 to $133.9 Billion by 2023.

That’s it for now.

If you want to know more about other entrants contributing to the “Prepaid Cards Revolution in India”, do subscribe to my blog mailing list and checkout my exclusive blog post.

Thank you so much for taking the time to read my article! Really appreciate the continued support!

If you have a related query, feel free to let me know in the comments below.

Be part of my FinTech community by subscribing to my blog for more industry content and discussions

Also, share the article with the people who you think might be interested in reading it.

Please leave a comment and share your feedback; it’s what keeps me improving.

Would mean a lot to me and it helps other people see the story.

I look forward to your responses!

Thanks and Regards,

Neha Sahay

![]()

3 Comments

more info · September 30, 2021 at 5:25 am

Excellent blog!

Do you have any suggestions for aspiring writers?

I’m hoping to start my own website soon but I’m a little

lost on everything. Would you propose starting with a free platform like WordPress or go

for a paid option?

There are so many choices out there that I’m completely

confused ..

Any ideas? Appreciate it!

Virgie · October 7, 2021 at 4:14 am

I do not even know how I ended up here, but I thought this post

was good.

I do not know who you are but definitely you’re going to a famous blogger if you aren’t already

Cheers!

Maria Brereton · March 7, 2022 at 9:15 am

Thanks for the marvelous posting! I actually enjoyed reading

it, you will be a great author.I will make certain to bookmark your blog and

will eventually come back in the future. I want to encourage you to ultimately continue

your great work, have a nice weekend!