As most of the world is on lockdown trying to prevent further spread of COVID-19, it’s hardly surprising that people are massively turning to the Internet to buy what they need. Pandemic has made digital transfers a necessity rather than a convenience. For instance, online renewal payments for insurance has seen a considerable uptick globally. For nearly all businesses, online presence turned into the only survival option. E-commerce, lending platforms is booming, and more transactions than ever are performed online.

Today’s consumers use apps and e-com sites for their shopping needs. Right from festive shopping to weekly grocery needs, online is the place to go.

In fact, the first online marketplace evolved in the 1990s to buy and sell used goods. And, now it has become a necessity, given the current situation.

At a time of social distancing and self-isolation one on one with the Internet, the payment ecosystem is becoming more diverse with different vendors offering different pieces of an omni-channel payment solution. By procuring independent services, it was now both possible and affordable to build a holistic modular card programme that could better serve customers’ needs.

Moreover, in the last decade, the Fintech industry has gone through a wave of innovation. It has created new journeys for banks and businesses and transformed the way you pay, lend, borrow, save, invest, insure, and so on.

Infact, FinTech isn’t new, but the reach of its usefulness continues to spread into unexpected areas. One such area is card issuing.

“Card issuing is the ability of financial institutions to issue debit or credit cards—either physical or virtual.

It was breathtaking to witness this rapidly changing landscape, which triggered a wave of innovation and gave rise to challenger banks and niche card products.

Finally, let’s go straight to the point and look under the hood of the card-issuing machine offered by emerging Fintech companies.

Why does it generate so much buzz?

Card issuing and processing platform connects directly with network endpoints. It allows its users to issue personalized branded payment cards and help manage the entire end-to-end card lifecycle. Provide the ultimate cardholder experience with credit and debit card products and services that simplify payments. Credit and debit card issuing also helps you grow your portfolio.

There are a variety of players in the card issuing space , such as Marqeta, Stripe, M2P Solutions Pvt Ltd, and so forth.

The evolving card issuing landscape:

Originally, banks became card issuers and card managers to provide their customers with a convenient way to access their bank account. But card issuing and card management was never the core business of the bank. Over the years many traditional banks have delivered card payment services on a ‘license to operate’ basis, meaning that they have typically issued basic products like debit, credit and prepaid cards and have not shown any interest in differentiating themselves through these products – often due to the modest business case of these products compared to ‘core banking’ products like lending and investments.

Along the way, the traditional banks were joined by a growing number of modern banks which embraced the options for using cards as a means to differentiate their payment products and strengthen their customer acquisition and retention through attractive or innovative card products and services. The latest addition to the card issuing landscape is represented by challenger and neobanks, e-commerce and retail merchants, and insurance companies as well as global technology companies. Much like the modern banks, the neobanks have been busy bridging the gaps in the card issuing market that many traditional banks have not addressed sufficiently (so far). While refraining from disrupting the card industry completely, they are indeed revitalizing the card industry. The neobanks seem to be releasing the full potential of cards and card payment services by making them the focal point of additional services which places the cardholder at the center of the payment experience. Today, they are growing their user base by improving on traditional card products and providing the customer with high-demand features, namely real-time information on transactions, convenient onboarding processes and product control (e.g. spending limits and geo-blocking). As a result, the traditional banks are feeling the pressure of the increased competition. Many traditional banks have overlooked the value in the fact that payments is the most frequently used financial service for most consumers and, as such, plays a vital role in the ongoing issuer and cardholder relationship. Should the banks lose this daily engagement with their customers, they will also lose an important foundation for selling the more traditional banking products like lending and investments. Payments as a mean of consumer interaction are also what drives the big retailers and global technology providers to embrace card issuing. These players are using card issuing to strengthen customer relations and loyalty, to improve conversion rates (e.g. by offering payment in instalments) and to reduce their interchange costs. Entering the card issuing space, these two groups of players add to the pressure on existing traditional card issuers as both groups are typically much more experienced in building and driving loyalty programs and value-added services.

Card Issuing: Key Features and Impact on the Global Development in Banking Technology.

The card issuance market used to be dominated by banks. However, now fintech companies stakes a claim for its piece of the pie. Its new API empowers business owners to create, control, and distribute physical and virtual credit cards with no need to wait for months. Among the essential functionalities are:

- Profitable, Long-term Cardholder Relationships : Reliable, fast, and secure, card issuing platforms provide the flexibility to offer cardholders the best possible experience.

- Configurable expenditure limits: Companies get full control over card expenses through the dashboard or through their automated API. Consequently, you can set spending controls for every card, block business categories, and even elaborate specific combinations of rules to prevent fraud.

- Instant transaction authorization: With these cards, you get access right to the authorization process, thus being able to control each charge in real-time. As a result, a smooth and seamless experience for end-users complemented with better awareness and security for business.

- Branded credit cards on-request: Business owners can create custom designs for their carriers and cards directly from their dashboard. The latter takes on the production and printing of cards and promises to deliver them at the earliest.

- Ability to add cards to mobile wallets: These days digital wallets are gaining momentum and especially in the days of social distancing. With issued credit cards, customers can load physical and virtual cards to their mobile wallets and access funds to pay in-store, in-app, or online quickly and securely.

- Grow Non-interest Revenue : Offering credit cards expands your product lines and diversifies revenue. Infact, their rewards programs help keep your financial institution top of mind, top of wallet.

- Full control of your funds using a single payments platform: Get a transparent overview of your cash flow with acquiring and issuing on one global platform, and control funds without relying on any legacy solutions or additional companies.

Infact these cards will be available in virtual and physical (plastic) form, offering multiple benefits to consumers as well as business users. Consumers can accumulate and monetize loyalty points, use the card as a multi-currency travel card or as a virtual card. Business users can use cards for business-related travel & expenses, payroll, and payouts and disbursement to their employees and vendors.

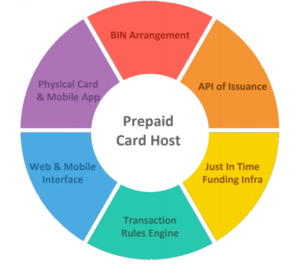

Platform Offerings:

Through the innovative use of new technology, a move to cloud-based services, and a radical rethink of pricing structures, new generation of card issuers is dramatically widening access to the world of payment card products. These new issuers:

- Allow customers to integrate their services through open APIs. This approach maximizes interoperability with existing technology, and dramatically simplifies implementation and operation. Open API platform and advanced analytics provide unprecedented control for banks to issue cards, authorize transactions, and manage payment operations with ease.

- Offer every element of the process through one integration. From KYC through to physical or virtual card fulfilment, the leading issuing platforms offer end-to-end solutions.

- Take a platform approach. Card issuing and management is just one part of a one-stop solution covering the entire payments process, which customers can understand and control at levels of extreme granularity.

- The platform connects directly with network endpoints. It allows its users to issue personalized branded payment cards and help manage the entire end-to-end card lifecycle. It supports its card processing by Just-In-Time ( JIT) funding to enable the funding of transactions real time.

Just-in-Time (JIT) Funding is a method of automatically funding an account in real time during the transaction process

- It supports both mobile and web interface. Actionable data insights, reporting, and advanced analytics tools

- It enables modern payment solutions for: In-app provisioning to digital wallets and PCI compliant virtual card presentment.

To better understand the benefits and scopes Card issuing platform and to communicate with them more effectively, it’s important to have a clear understanding of what the term issuer mean and what’s the role of issuers has in the card ecosystem.

So, What is an Issuer?

The simple answer is that issuers (issuing banks) are institutions who issue credit and debit cards to consumers. The credit card issuer acts as the middle-man between the consumer and card schemes like Visa and Mastercard. The card schemes have ultimate control over cards that bear their logo, but the issuing banks do a lot of the legwork…and take on much of the liability.

“An issuer—sometimes called the issuing bank or card issuer—is a member of a card scheme, and issues credit cards to consumers. They provide banking services to customers, allowing individuals to initiate purchases using payment cards.”

Issuers serve an intermediary role between their customers and the card networks, and some card networks—Discover and American Express, for instance—serve as their own issuing banks. The issuer enters into a contract with their customer and extends them a line of credit, which the customer can then use to make purchases on credit and pay the issuer back with interest. Liability for non-payment is primarily taken on by the issuer, but card networks often have rules that require issuers and acquirers to share liability. When a customer makes a purchase with their card, their issuing bank communicates with the merchant’s acquiring bank and transfers the funds to them. The acquirer will then place those funds in the merchant’s account, after subtracting any fees or other related charges.

Understanding the Process & Role of the Issuing Bank

A typical transaction starts when the cardholder uses a payment card for a purchase. After the customer submit his or her transaction:

- Card information is sent from the merchant to the payment processor.

- The processor submits the request through the card scheme, then on to the issuing bank.

- Issuing bank checks whether the card account is active, whether the requested amount is available to the account, and more.

- The transaction is either authorized or denied, with the decision being transmitted back the way it came, from card scheme, to acquirer, to merchant.

- The merchant sends batches of authorized transactions to the processor, and eventually funds are transferred from the cardholders’ accounts to the merchant account.

As mentioned, this is a typical transaction. There are numerous opportunities along the road where the process can deviate from the norm.

When the credit card issuer provides a customer with a payment card, it is essentially extending a line of credit to that consumer. The bank provides the financial backing for any transactions made with the card. In other words, the bank is assuming the responsibility for the cardholder’s ability to pay off any debt accrued by use of the card.

When a bank wants to issue a credit card to their customers, representatives start by working closely with the scheme to craft a co-branded card. This includes building a rewards program that incentives consumers to use the new card over any others they may have.

Part of the network’s job is to provide customer service while making sure cardholders are able to use their cards as universally as possible. The issuing bank, on the other hand, handles individual authorizations, as well as providing ongoing services to the account. These include:

- Sending card renewals

- Setting or raising individual card limits

- Resolving disputes

- Activating new cards

- Suspending accounts or blocking charges when necessary

Most importantly, it is the credit card issuer’s job to protect the consumer’s personal information, financial data, and account access. This includes maintaining high levels of security for stored data and transaction connections, but it can also involve account monitoring. For example, banks may monitor purchases by type, location, or total transaction total, as dramatic variations from the norm in these areas could indicate fraud.

Why Are Issuing Banks & Card Schemes Necessary?

For the most part, card schemes work on behalf of multiple member issuers. There are exceptions, however; American Express, for example, functions as both a card network and issuing bank. It can get confusing, but there’s no law that prevents a company from both issuing and facilitating card purchases. If that’s the case, though, why don’t all credit card issuers do that?

As mentioned above, there are multiple players involved in every card transaction. For banks to process their own card transactions, each would need to build out its own network and establish relationships with other institutions to facilitate interbank transactions. It would be incredibly complicated, messy, and inefficient.

Card schemes are interbank networks. Rather than requiring every issuer to transact with every other bank, they can all use the card scheme as a universal, impartial middle man. So, while adding more steps to the process isn’t necessarily idea…it’s better than the alternative.

That said, there’s always the chance that customers could default on their credit card balance. Banks are required to underwrite the risk. Visa and Mastercard are not banks; they’re more like custodians of their respective brands. They serve as overseers of all the various parties involved in the process.

In practice, this means that if a cardholder is not able—or simply decides not—to pay a card balance, the networks are off the hook. It’s up to the issuing bank to try and recoup the costs from the customer. Thus, it makes sense that whenever cardholders dispute fraudulent or unfamiliar charges, the issuing bank has an incentive to proceed with a chargeback.

All-told, banks do a lot of work and accept a lot of risk to issue payment cards. That’s why issuers charge a fee for every card transaction.

Now since you read and cleared the basics of issuers and its functionalities, let’s dive into the challenges faced by card issuers benefits of card issuing.

The challenges faced by card issuers today.

The card issuing landscape is getting increasingly crowded as new players spot an opportunity to tap into the unresolved growth potential of the card payments industry to pursue their own objectives. This development, which urges card issuers (and traditional card issuers in particular) to transform their card processing platforms to remain competitive, is further reinforced by a number of internal and external challenges. With increasing internal and external pressure, business as usual is not an option. In the case of the illustration below, irrelevance refers to the potential irrelevance of issuers in the eyes of the consumer/market. If the issuer does not adequately react to the challenges described below, then the consumer will simply abandon the issuer and choose a competitor who does.

EXTERNAL CHALLENGES

- New entrants are increasing competition: The new digitally fluent fintechs, challenger banks and global technology companies are leveraging technology to deliver innovative solutions to high-demanding consumers. Looking to improve the flexibility, configurability and time-to-market capabilities of their issuing platforms to remain on par with the market, many traditional card issuers are challenged by legacy systems and the fact that they are managing numerous segmented card portfolios.

- Payment channels are diversifying : The recent advancements in technology have led to the proliferation of alternative payment channels and tools, including examples like digital wallets and wearable devices. With the growing amount of available payment channels, card issuers are challenged by the expectations of demanding consumers to deliver a consistent, coherent and controllable end-user experience, both in online and offline payment environments.

- Consumer preferences are developing: With the rise of the internet and the proliferation of mobile devices, consumers – and younger generations in particular – have adapted to a new way of interacting and transacting. Today, consumers expect (card) payments to be a convenient, instantaneous, flexible, personalized and secure digital experience. In line with this development, many traditional card issuers could benefit greatly from the ability to tap into card data streams to deliver more personalized products and services to consumers and increase customer loyalty.

- New technologies are disrupting financial services: The digital era has accelerated the advancement of disruptive technologies in financial services. Presently, it is becoming increasingly clear how leveraging these technologies and technology-enabled features can help financial institutions transform their banking businesses into more efficient and customer-centric versions.

- Payment processing has become a commodity: With the increased standardization and commoditization of payment processing, financial institutions are forced to focus on efficiently processing massive volumes to sustain the increasingly lower margins on payment services. This means that only very few issuers will have sufficient volumes to make the business case viable. At the same time, the increasing commoditization of issuer processing allows little room for differentiation. Regulation is increasing the compliance burden. Since the financial crisis, many new regulations have been passed to increase the resilience of the financial system. Financial institutions, for their part, have been forced to scale up their compliance management functions to stay ahead of legislators and avoid fines and penalties

INTERNAL CHALLENGES

- Legacy systems are preventing digital transformation: The leading challenge for many traditional card issuers is still entrenched legacy systems. Known for eating up large portions of IT budgets, these complex and siloed systems are inflexible and expensive to maintain and impede the institutions’ ability to scale, innovate at speed and deliver value-added features and excellent customer services to consumers.

- The inability to leverage card data analytics is becoming critical: The fact that most financial institutions struggle with intricate and rigid legacy systems makes it a lot more difficult for them to leverage the vast amount of data points produced by customer card transactions. The ability to collect and analyze card data is imperative as it can be used to better understand customer behavior, develop new customer-centric products and services, predict future payment patterns and trends, discover and fight fraud (in combination with advanced technologies like Artificial Intelligence), reduce chargebacks on the merchant side and determine how and where to make business improvements.

- Data privacy: After an increasing number of data breaches and other incidents involving misuse of personal data, data privacy is very much top of mind with consumers and regulators, as the amount of customer data produced through payments is enormous and of a very sensitive nature.

- Fraud mitigation becomes a differentiator: While protecting personal and sensitive data is becoming more important to consumers and regulators, protecting the actual monetary transactions against fraud has always been an essential part of the card business. As the sophistication of attacks is constantly increasing, security features have evolved into a competitive differentiator. As such, card issuers are expected to have risk mitigation solutions in place to protect consumers against card-not-present (CNP) fraud and counterfeit card use as well as for managing data breaches and facilitate safe and secure payment transactions.

- Compliance related cost is increasing: Financial institutions are struggling to manage and conduct the increasing number of compliance procedures being put in place. While compliance management costs continue to rise, the resources left for most card issuers to focus on new service development and innovation shrink in response

In search of a future-proof solution

Driven by the internal and external challenges described above, cards and card based payments are currently transforming from a pure commodity product to being the subject of innovation and differentiation. This transformation is changing the requirements placed on traditional card issuers as well as on their card issuing

platforms. In the new environment, the ability of card issuers to adapt quickly to changes in the market and to organize themselves around customer experiences is key. And for that, card issuers need a modern and standardized card processing service that:

- improves time to market for new and innovative card products and services

- offers real-time interfaces and instant card issuing

- is capable of extracting valuable analytics from card transactions

- offers a range of plug-in value-added services on top of the card issuing processing

- is scalable for large card transaction volumes at a predictable monthly cost

- is robust, reliable and available 24/7

- is compliant with current regulatory requirements and designed to adapt easily to future requirements

While the legacy systems of many traditional card issuers have reached their limit regarding flexibility and speed, card issuers are faced with the question of how to proceed. Should they adopt a ‘build-and-adapt’ approach, buy a ready-made solution ‘off-the-shelf’, outsource the solution to an external party – or opt for a combination of the available options? For new players entering into card issuing, in-house development or installation of standard products are not viable nor attractive options as these players do not see themselves as financial services providers (with all the effort that this entails). Rather, they seek ways to leverage payments to improve their existing service offerings, making payments the value-added service rather than it being the other way around. For these players, sourcing issuing as a service from a specialized provider is just the only viable option available, and the strategic choice is not about the delivery model, but rather about the strategic fit of the supplier

Benefits of using a card issuing API

There’s a reason many fintech companies rely on APIs, to manage integrations. Security is already hard enough, but interfacing with individual financial institutions makes it even harder. Card issuing APIs offer the same benefit. The power of a complex service, wrapped in an approachable API that makes sense for products in a variety of industries.

As mentioned above, one of the core benefits of all of these services is the ability to offer on-demand virtual and physical cards. This allows companies to generate new cards as needed and manage how, where, and when they are used. Delivery companies can generate cards for drivers to use on fuel expenses. Construction contractors can issue cards for last-minute resupplies at hardware stores. Even political campaigns can issue cards to staff in order to better track expenses and limit spending.

Speaking of expenses, if your product relies on expense management, many card issuing APIs have this functionality baked in. Either through granular features like single-use numbers, through user specific cards, or through cards dedicated to specific categories of expenses. Many offer the ability to create digital wallets to offer even more constraints over how funds are used.

Many providers are also global-friendly, offering currency specific cards that allow users to avoid international transaction fees. This is especially useful for business targeting remote teams, as well as customers like travel agencies that benefit from purchasing flights and accommodations in different regions instead of through a single portal.

Perhaps the greatest benefit is that nearly all companies that offer card-issuing are developer-friendly. The competition has forced an increased focus on developer experience, and now you can implement many of these APIs securely and faster than ever before. On top of that, pricing is clear and upfront for many, rather than hidden behind a sales call.

These are just a few of the key features. The suite of offers keep growing into areas like ACH deposits, wire transfers, and more all tied to the card-issuing infrastructure.

What about the future of banking more generally?

The rise of the new card issuers also reflects some key trends in the general banking landscape, and gives some clues as to where the industry is heading.

The launches of Card issuer companies and its competitors are part of the huge transformation brought about by the advent of Banking-as-a-Service (BaaS). The leaders in the BaaS field have delivered a paradigm shift in transparency, accountability, and customer-centric approaches, and they will continue to radically change the banking landscape. Card issuance is a key element of the BaaS field, but it is only one part of a huge ecosystem. Today, it’s possible to launch entirely new financial products in a matter of months.

The new approach represented by BaaS is based in great part on the use of open APIs. Rather than having to negotiate with old, bespoke, and confusing legacy systems, companies of virtually every size can build services quickly and easily through simple API integrations – as we’ve seen with Marqeta, Stripe, and others. In the coming years this new simplicity will lead to an even wider range of new entrants to the financial services market, with nimble startups able to turn good ideas into solid products in record time and with low outlays.

“Nearly every company will derive a significant portion of its revenue from financial services,” a shift that is being made possible by BaaS. From new, dedicated card issuers all the way up to complete BaaS platforms, there is now an entire ecosystem providing businesses with the tools they need in order to add deep financial services integrations into their existing products, or build entirely new ones, in a way that has never been possible before.

Conclusion:

As digitization and technology continues to change the way we interact and transact, payment expectations are changing too. Consumers expect much more from their financial service applications, which are expected to be seamlessly integrated into their every-day lives.

In this changing financial services environment, the ability of card issuers to operate cost-efficiently, adapt quickly in the market and to organize themselves around customer experience is key.

In a rapidly changing payments landscape, alternative payment methods are emerging to meet the expectations of consumers online. The rise and consolidation of these new payment methods alongside established payment methods like card payments are supported not only by an increase in Internet and smartphone penetration, but also by a continuous growth in retail e-commerce transaction volumes.

This quiet revolution in card issuing comes in the midst of broader, sweeping changes to the payments landscape more generally.

In the broadest sense, the boom in card offerings will likely continue the weakening of the link between consumers and banks. Consumers are becoming increasingly comfortable entrusting elements of their financial life to non-bank organisations, and this trend looks set to continue, thanks in part to the ability of smaller and newer market entrants to produce their own card offerings.

More flexible card issuing may also enable further growth in alternative finance. Similar changes seem inevitable in business finance, with more and more B2B lending being carried out through instantly-issued virtual (or physical) cards.

That’s it for now.

So what do you think Is payment card issuing truly becoming a differentiating domain? Or is it just a commodity? Let me know your view points in the comment below.

If you want to know more about other entrants contributing to the “Card Issuing Revolution in India”, do subscribe to my blog mailing list and checkout my exclusive blog post.

Thank you so much for taking the time to read my article! Really appreciate the continued support!

If you have a related query, feel free to let me know in the comments below.

Be part of my FinTech community by subscribing to my blog for more industry content and discussions

Also, share the article with the people who you think might be interested in reading it.

Would mean a lot to me and it helps other people see the story.

I look forward to your responses!

Thanks and Regards,

Neha Sahay

![]()

0 Comments